I am currently renting and putting away a considerable amount of my monthly salary into saving to buy my first home.

Right now, I have enough for a 25 per cent deposit in the area where I want to live. The issue is that as a single person, my salary isn’t enough to borrow the mortgage I need on the rest.

I am wondering whether I would be better off buying a cheaper property as a buy-to-let, to get on the ladder and hopefully acquire an asset that grows in value.

Dilemma: While our reader has a big enough deposit to buy where they want to live, they don’t have a large enough income to secure a mortgage

I understand that mortgages for buy-to-let properties are based on the rent that can be charged, instead of the person’s income.

Will I be able to get a buy-to-let mortgage, and what rates should I expect?

Second, could I buy and then rent the flat from myself as long as I pay market rent?

Third, the area I want to buy is not particularly high yielding in terms of rents. Should I purchase a buy-to-let in a more up and coming area where rental returns are higher as a proportion of property values?

Ed Magnus of This is Money replies: This is a common predicament faced by many young people getting on the ladder.

While for many, raising a sufficient deposit is the biggest barrier to them getting on the ladder, there are plenty of others who have the deposit but can’t get a big enough mortgage due to their income – particularly when buying alone.

This is because most mortgage lenders tend to limit borrowers to a maximum borrowing of 4.5x their annual income.

This can be a major problem in locations where house prices are much higher than average earnings.

Take London, for example, where the average price of property is £508,000, according to the latest Land Registry figures.

Even if someone here had a 25 per cent deposit equating to a staggering £127,000, based on a 4.5x income multiple, they would also need to earn almost £85,000 a year to get the mortgage they needed.

Our reader clearly has a specific type of property they want to buy and a specific area they want to live in. That’s fair enough, given it may well be the biggest financial decision of their life.

It is possible to purchase a buy-to-let property instead, although mortgage options may be limited.

There are also various tax related downsides when doing so. First, is the loss of principal residence relief when you come to sell.

This tax relief means homeowners are not charged capital gains tax on any gains they make when they sell their main home.

This is not the case for someone selling a buy-to-let property they have never lived in, meaning capital gains tax is charged at 28 per cent of the gain for higher rate taxpayers or 18 per cent of the gain for basic rate taxpayers.

There could also be a knock-on impact when it comes to the stamp duty land tax (SDLT) they pay in the future.

People are classed as first-time buyers regardless of whether they are buying a property to live in or let out, so that will mean you will get relief on your initial purchase.

At present, first-time buyers are exempt from stamp duty on property purchases up to £425,000, whereas for a normal home mover it starts at £250,000.

The problem may arise when you eventually do buy a property to live in, as you will no longer qualify for that relief.

If you keep hold of your buy-to-let investment, you will also be hit with a 3 per cent stamp duty surcharge for being a second home owner.

For example, if you were to keep hold of the buy to let investment and go on to buy a home to live in for £400,000, this will mean you end up being charged £19,500 in SDLT compared to the £0 charged as a first-time buyer.

For further expert advice, we spoke to Chris Sykes, technical director at mortgage broker Private Finance and Mark Harris, chief executive of mortgage broker SPF Private Clients.

How much can they borrow?

Mark Harris replies: Rising rents have made it difficult for first-time buyers to save for a deposit so it’s impressive that you have managed to raise 25 per cent, increasing your mortgage options and potentially reducing the rate.

However, as you are buying on your own, your income is insufficient to achieve the borrowing required.

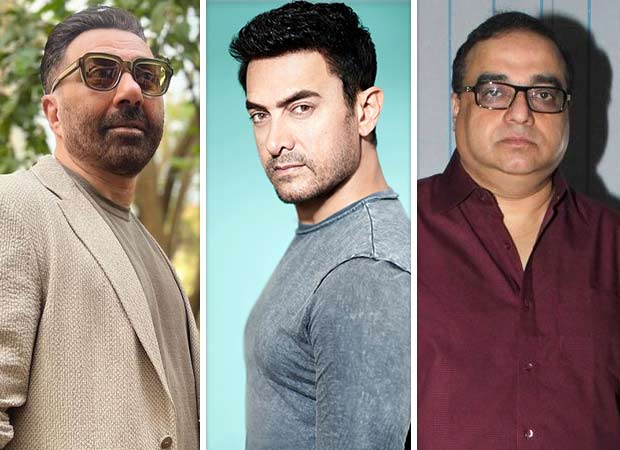

Expert: Mark Harris , chief executive of mortgage broker SPF Private Clients

Lenders tend to lend up to 4 or 4.5 times income, giving slightly more to those on higher salaries.

Check that the lender takes all income sources into account when deciding how much you can borrow. If you are in receipt of variable or non-guaranteed bonuses, these may be excluded.

If you were to buy a property to live in, you may be able to boost the size of your mortgage by utilising the income of assistors, such as parents, via a guarantor scheme or a joint borrower sole proprietor mortgage. This is where the lender allows more incomes to be included in the affordability assessment.

Alternatively, if you planned to rent out a spare room, some lenders may take this income into account when deciding how much you can borrow.

The rent-a-room scheme lets you earn up to a threshold of £7,500 per year tax-free from letting a furnished room.

Chris Sykes adds: There is a chance you could borrow more than you think, in order to buy your own home.

Mortgage rates have eased off over the past few months, and lenders such as Perenna are able to consider lending up to six times annual income.

Can they buy their first home as a buy-to-let?

Chris Sykes replies: This is something that I’ve seen several clients do, especially London clients.

They will buy out of their own area so that they can afford to get on the property ladder, even if it is not a property they intend to live in.

Out of town: Chris Sykes of mortgage broker Private Finance says first-time buyers looking at buy-to-let should find somewhere far from where they live if they want to get a mortgage

Will they have trouble getting a mortgage?

Chris Sykes replies: There are plenty of lenders that do buy-to let mortgages.

Some will require you to be a homeowner in order to get one, which would rule you out.

But there is also a subset of lenders that are happy with ‘first-time buyer, first time landlord’ applications.

Just be aware that buy-to-let lenders may need to assess you both on the rental income, and on your own income and outgoings.

We’d also need to give a lender a really good story as to why you are doing this, why you aren’t looking to buy your own home, etc.

The rule of thumb is a buy-to-let needs to be far outside of the area you live in.

It’s also worth pointing out that buy to let mortgage rates already come at a slight premium, so further narrowing the pool of lenders would attract a slightly higher premium.

Mark Harris adds: Opting for a buy to let as your first property can be problematic.

Lenders may be concerned that you plan to live in the property yourself rather than rent it out, which is a big no-no for them.

So they tend to base borrowing on an income basis, rather than the rental income and you’ll have to pass a standard affordability assessment.

Could they buy and then rent the flat to themselves?

Chris Sykes replies: No, definitely not.

They would need to be assured you would not be living in the property at any point.

One of the mortgage conditions of most buy-to-let mortgages is that you or your family are not able to live in a buy to let you own.

Should they look for higher-yielding areas to invest?

Chris Sykes replies: This is often what people do. For example, they may live in London, but purchase buy to lets in York, Leeds, or Sheffield where there are much higher yields.

The main consideration with this is making sure you are aware of any management fees involved with buying out of the area you live in.

Mark Harris adds: Many investors opt for higher-yielding areas as it not only potentially diversifies their portfolio, it allows the potential to borrow more.

As a landlord, you may also benefit from that property having a lower asset price (for example, if you bought in Leeds rather than London).

What else should they consider?

Mark Harris replies: With buy-to-let looking tricky for you, it may be worth exploring other options.

For example, could you increase your deposit further? Is there a family member who could assist, perhaps the Bank of Mum and Dad?

Utilising family savings pots or equity within an existing property may make a difference to how much you can afford.

Other schemes which may be worth a look include shared ownership, or specialist products such as Skipton Track Record which takes into account rent payments.

Long-term fixes may also be worth considering – some lenders have products fixed for the whole term of the mortgage and as the borrowing is stressed on the actual pay rate (as opposed to the higher standard variable rate), you could be able to borrow more.

Products are priced higher than other mortgages, but some, such as Perenna, have a limited early repayment charge period (five years in this case) which means you could switch later.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.