The third phase of the China Integrated Circuit Industry Investment Fund, also known as the “Big Fund”, was established last Friday with a registered capital of 344 billion yuan (US$47.5 billion), according to information made available on Monday by Chinese corporate database service Qichacha.

Big Fund III has 19 equity investors led by China’s Ministry of Finance with a 17 per cent stake, followed by the state-owned China Development Bank Capital with 10 per cent and state-asset manager Shanghai Guosheng Group with 8 per cent.

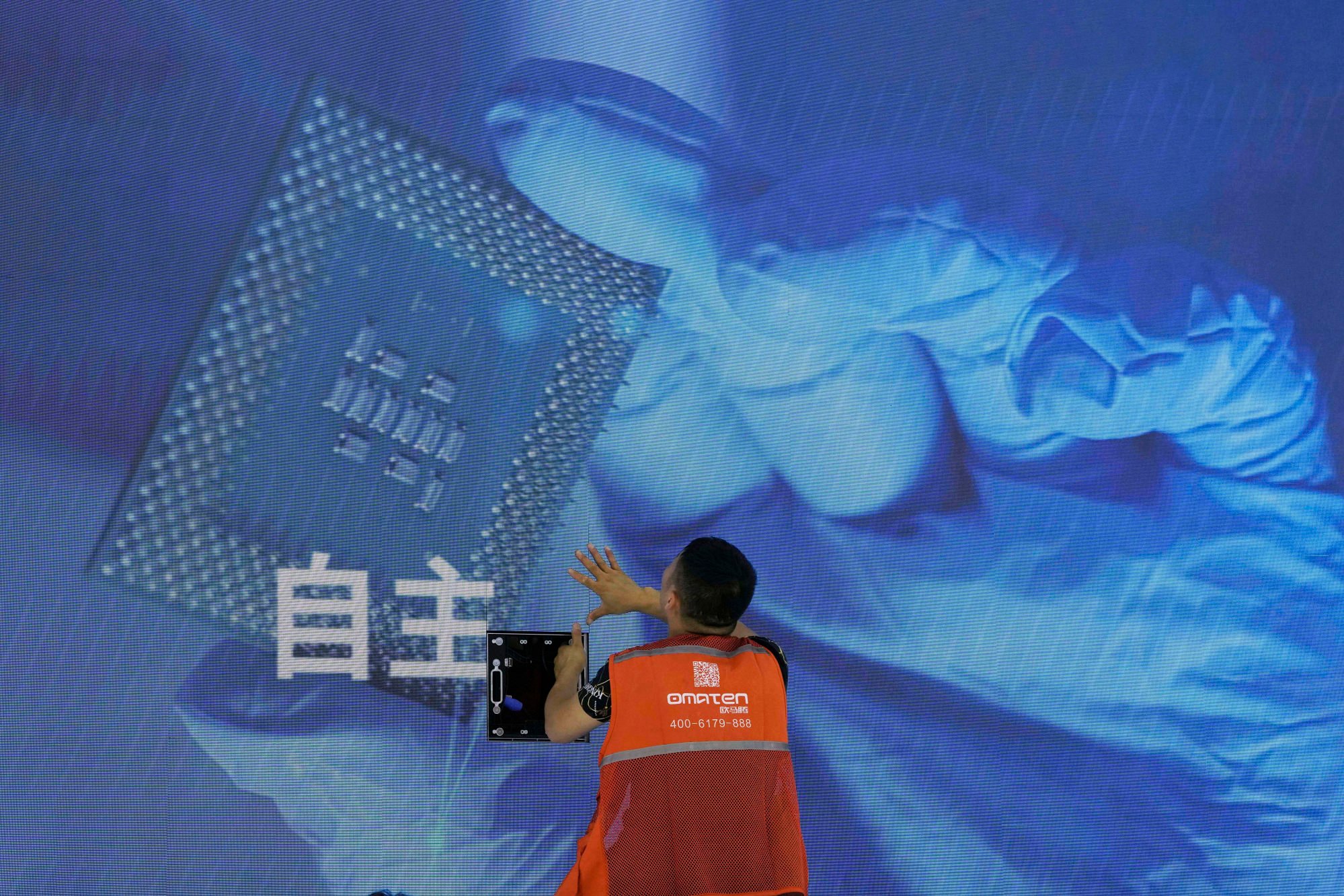

The size of that new fund – roughly on par with the US$53 billion in incentives under the Chips and Science Act, which was enacted by US President Joe Biden in 2022 – shows the Chinese government’s “whole nation” approach to build a self-sufficient semiconductor industry and overcome Washington’s export restrictions that have handicapped the sector.

Launched in 2014, the Big Fund has been Beijing’s main investment vehicle to support the domestic semiconductor industry’s development, particularly in the areas of chip design, manufacturing and packaging, equipment and materials. It is a major investor in SMIC and Chinese memory chip giant Yangtze Memory Technologies Co, which are both in the US government’s trade blacklist.

China’s semiconductor industry, meanwhile, continues to show its strength in producing older-generation legacy chips that are widely used in cars, home appliances and various consumer electronics. China’s global share of mature semiconductor-manufacturing capacity – covering 28-nanometre and older technologies – is expected to reach 39 per cent by 2027, up from 31 per cent in 2023, according to market research firm TrendForce.

Last December, a US move to investigate American companies’ procurement of Chinese-made legacy chip triggered a backlash from Beijing, which blamed Washington for “weaponising” trade issues.

That further exacerbated geopolitical tensions amid heightened accusations from the US and Europe that China’s excess industrial capacity has strangled their own manufacturing sectors.

Despite Beijing’s efforts to bolster its domestic semiconductor industry, major manufacturers like SMIC remain largely dependent on foreign chip-making equipment, such as those from Dutch supplier ASML.

Denial of responsibility! Pioneer Newz is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – [email protected]. The content will be deleted within 24 hours.