Real estate sector is immensely important for the Indian economy. Image courtesy Moneycontrol

There is an age-old adage: Nothing is certain except death and taxes. Budget 2016 lived true to the adage with the re-introduction of the long-term capital gains tax on the sale of listed shares. Such gains were hitherto exempt from tax.

Indian capital markets have been on a purple patch. Stock indices have touched all-time highs. It is but natural for cautious investors to book profits and rebalance or diversify their investment portfolio. Such sale transactions may result in long-term capital gains taxable at 10 per cent (in case of listed shares held for more than 12 months) or 20 per cent along with indexation benefits (in case of unlisted shares held for more than 24 months) (tax rates discussed are applicable for resident individual and excludes surcharge and cess). This could raise the tempting thought on whether one could have the cake and eat it too? That is, to enjoy long-term capital gains without being subjected to any taxes. Investment in real estate can help in tax harvesting on such long-term capital gains on availing certain beneficial provisions under the tax laws.

The real estate sector has been a major contributor and enabler of the growth of the Indian economy. A favourable and stable tax policy is important for the sustained growth of the sector. With Budget 2024 around the corner, it is an opportune moment to consider budget expectations of the real estate industry. Part 2 of the article delves into few key industry expectations from a tax perspective.

Related Articles

Parliament Budget Session 2024 to be held from 31 Jan to 9 Feb; FM Sitharaman to present interim budget on 1 Feb

Union Budget: Assessing impact of anticipated personal finance adjustments

Part 1: Investment in real estate for tax-savings

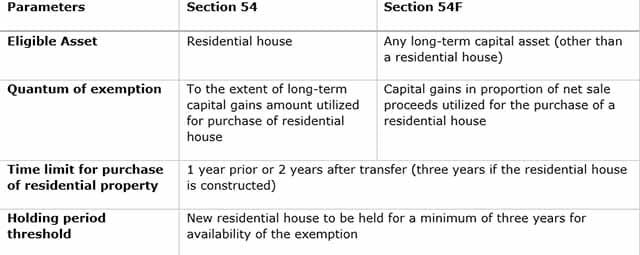

Section 54F provides for exemption (to an individual or HUF) on capital gains arising on the sale of any long-term capital asset (other than a residential house), if net consideration is re-invested on the purchase of a residential property (provided that the taxpayer does not own more than one residential property at the time of sale).

Section 54 provides a similar exemption on long-term capital gains arising on sale of a residential house, if such gains are re-invested in another residential house. A taxpayer also has the option to invest in two residential house properties in India, to claim section 54 exemption (this option can be exercised by the taxpayer only once in his lifetime provided the amount of long-term capital gain does not exceed Rs2 crore).

The exemption is subject to certain riders. Encapsulated below are key provisions one should make a note of:

It is pertinent to note that Budget 2023 imposed a limit of INR 10 crore for deduction on long-term capital gains tax for reinvestment in residential house under Section 54 and 54F. No limit existed earlier. The amendment was introduced to prevent huge deductions claimed by HNIs on purchase of high-end luxury houses.

Part 2: Key budget expectations for real estate industry from tax perspective:

REIT tax framework – tying the loose ends: In past budgets, the government rationalized the REIT tax framework to iron out key developer and investor concerns. This has given significant traction to successful REIT listings. There are still few areas which need to be addressed to further incentivise this product and correct anomalies: (i) tax exemption is only provided for swap of shares of a special purpose vehicle with REIT. Other forms of transfers such as ownership of real estate assets, interest or rights, should also be covered within the scope of the exemption; and (ii) since listed units of REIT are akin to listed shares, period of holding to qualify as long-term capital asset for REIT units should be reduced to 12 months from existing 36 months.

Taxation in Joint Development Agreements (JDAs): A developer (being individual or HUF) is subjected to capital gains tax only at the time of completion of project in relation to gains arising on transfer of immovable property under the JDA agreement. Such beneficial provisions should be extended to all categories of taxpayers to simplify the taxation of all JDA transactions.

Rationalise stamp duty: Stamp duty is a very important cost factor in any immovable property transaction. Central and state governments should consider measures to rationalise stamp duty mechanism to provide fillip to real estate purchase transactions.

GST input tax credits: Certain provisions under the GST framework, impose restrictions to avail input tax credit on construction of an immovable property. This has resulted in an increase of construction cost and in cost of doing business. Since there is a direct nexus between construction services received by the commercial developer and activity of renting/leasing of space, input credit of such taxes paid should be allowed to the developer.

GST levy on inter-company transactions real estate: Recently, there have been conflicts on GST levy on inter-company transactions such as guarantee, brand usage etc. Many real estate players have received GST tax demand in this regard. The government/GST Council should provide clarifications on GST levy and valuation aspects of such inter-company transactions to resolve the conflicts.

In conclusion, the proposals if implemented will pave way to resolve critical tax pain points and in turn enable overall growth in the real estate sector.

The author is Partner, Deloitte India. Views expressed in the above piece are personal and solely that of the author. They do not necessarily reflect Firstpost’s views.

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.