- Raspberry Pi’s first-half adjusted earnings before nasties jumped by 55%

- Orders of its single-board computers and compute modules rose to 3.7m

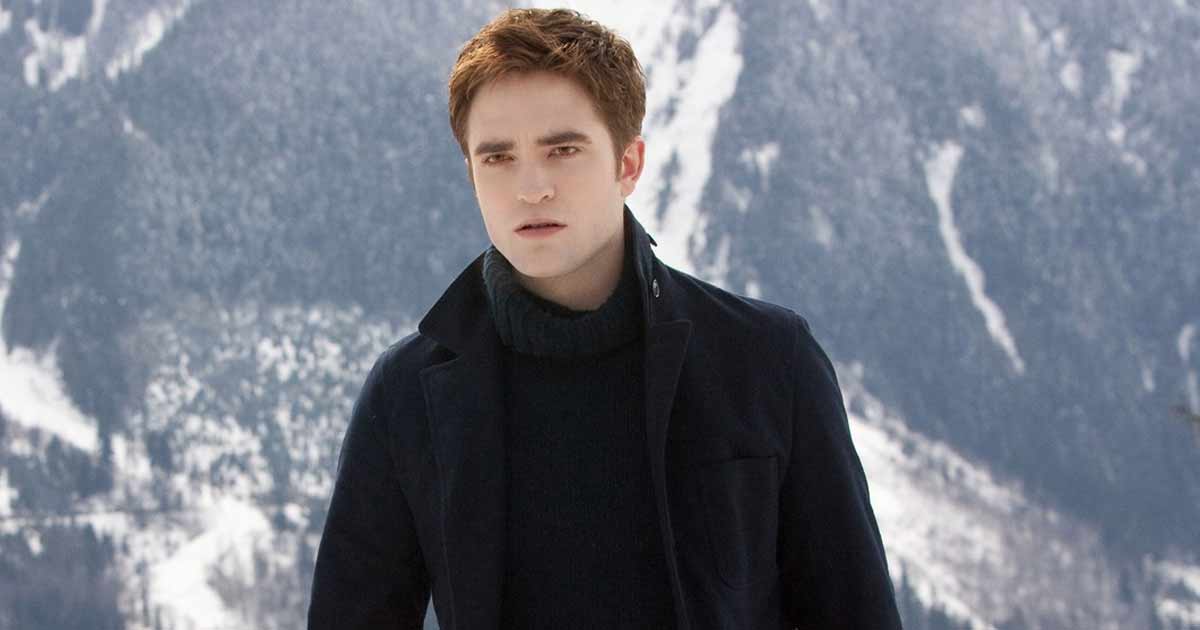

Raspberry Pi’s profits soared in the first half of 2024 as the group enjoyed strong demand for one of its recently launched single-board computers.

The budget computer maker, which went public on the London markets in June, revealed adjusted earnings before nasties jumped by 55 per cent to $20.9million (£15.6million) in the six months ending June.

It told shareholders it sold 1.1 million units of its Raspberry Pi5 during the period after introducing the product at the end of October last year.

Results: Raspberry Pi revealed its adjusted earnings before nasties jumped by 55 per cent to $20.9million in the six months ending June

This helped drive orders of its single-board computers and compute modules up nearly a third to 3.7 million.

Raspberry Pi also benefited from sales of semiconductor products growing to 2.1 million units and a recovery from the pandemic-related shortages that constrained trade during the first half of 2023.

Its revenue expanded by 61 per cent to $144million, with more than half the increase coming from components sales, as the volume of microchips supplied to the firm’s licensees rose amid improving supply chain issues.

The Cambridge-based company expects higher unit volumes during the second half of this year, again supported by new product launches, although it believes profitability will be first-half weighted.

Raspberry Pi just introduced a machine-learning hardware product – the Raspberry Pi AI Kit – in collaboration with technology firm Hailo and cloud connectivity product Raspberry Pi Connect.

The AI Kit came to market about a week before Raspberry Pi’s very successful initial public offering, which raised £178.9million for the business.

It told investors it would spend the cash on improving its supply chain, engineering projects, and ‘other general corporate purposes.’

Eben Upton, chief executive of Raspberry Pi, said the firm’s IPO was the ‘watershed moment of the first half’.

The Raspberry Pi listing represents a rare victory for the London markets, which have struggled to attract new IPOs and seen multiple companies bought by foreign firms over the past few years.

Only eight new companies went public on the LSE in the first half of 2024, compared to 47 over the same period three years earlier.

Many firms choose to list in the US instead of the UK because they can potentially access much larger capital pools and gain higher valuations.

Since its June listing, Raspberry Pi has entered the FTSE 250 Index, and its shares have climbed by around a third to 369.8p.

Raspberry Pi shares were up 6.2 per cent on Tuesday morning.

Mark Crouch, market analyst at investment platform eToro, said: ‘The potential rewards on offer in the AI industry is no secret, and with that comes a lot of competition, looking for a share of the spoils.

‘But with recent data suggesting the value of the AI market could be set to grow by as much as ten times by 2030, more tech investors could be eager for a slice of Raspberry Pi.’

Founded in 2009, Raspberry Pi is the highest-selling British computer ever and is particularly well-loved among hobbyists and amateur coders.

More than 60 million of the firm’s single-board computers have been bought in the last decade across over 70 countries.

Their products are often used in edge computing, which is the practice of capturing, processing, and analysing data close to where it is created rather than in a centralised data centre.

Analysts at broker Peel Hunt said: ‘Recent sentiment does not distract us from our view that edge computing will do to Raspberry Pi what the desktop did to Microsoft, the smartphone did to Apple, and the data centre is doing to NVIDIA.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.