Known as “underconsumption core”, it spotlights living sustainably and using what you have, a reversal of the excess and wealth that dominates ad-heavy Instagram and TikTok.

A video with over 100,000 views from TikTok user loveofearthco critiqued the tendency towards overconsumption often amplified and encouraged on social media, saying: “I spent money I didn’t have on things I didn’t need.”

Another account, nevadahuvenaars, shared what “normal” consumption looks like: used furniture, a modest wardrobe, decor upcycled from glass bottles, meal prep and a downsized skincare collection.

Despite financial hardships felt particularly by Gen Z and millennials, the US economy is thriving, with record corporate profits and high prices on shelves.

In a way, “that feels almost ‘gaslighty’ to consumers” amid a period of economic and geopolitical uncertainty, culture and consumer marketing analyst Tariro Makoni says.

But years of inflation have forced many to the conclusion that they cannot keep up with the spending habits of those on their social media feeds.

A Google Trends analysis shows US searches for “underconsumption” hit a high point this summer, surfacing alongside queries about “overproduction” and the “Great Depression”.

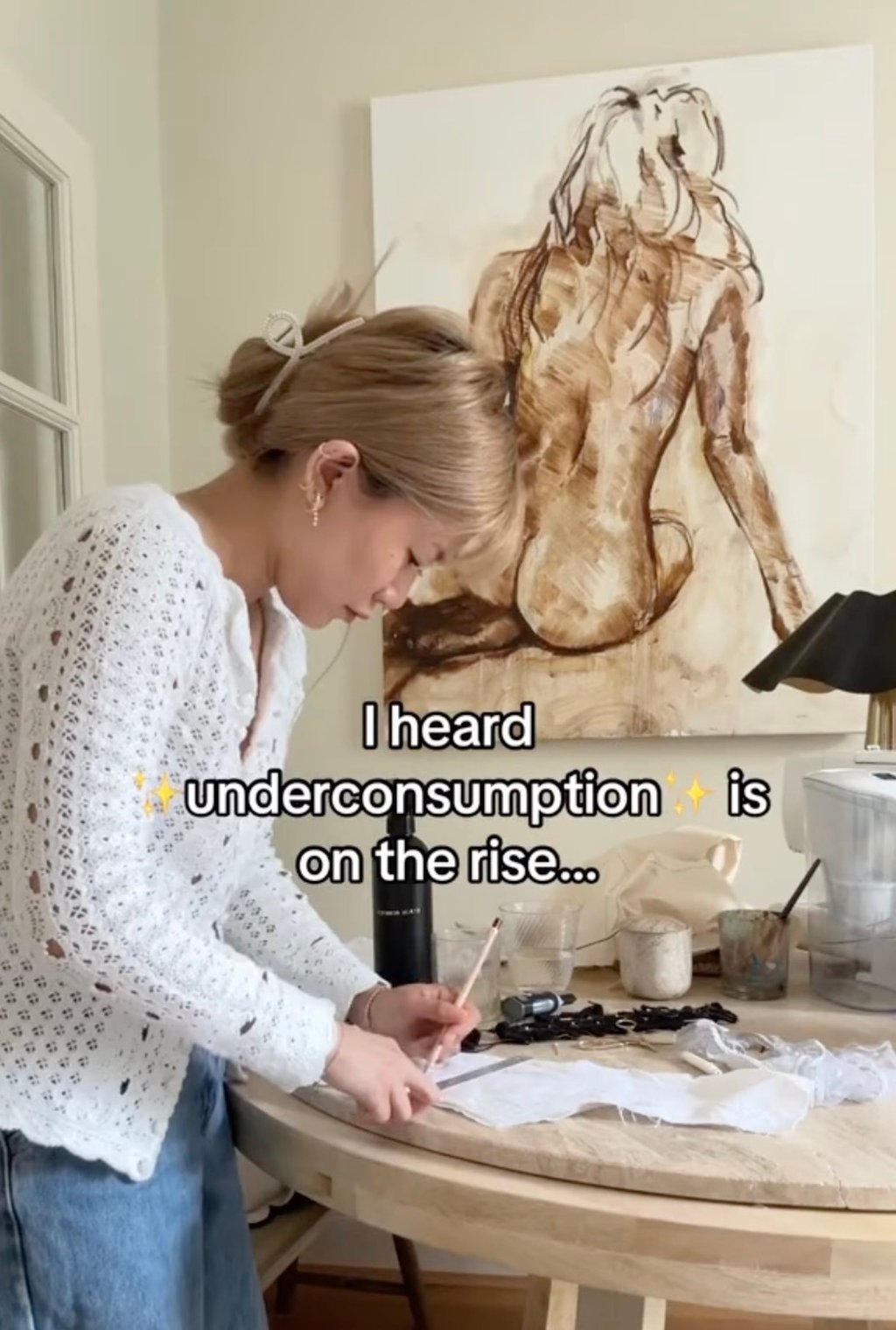

Many young adults have developed a “compulsive behaviour to spend down to their last pound on a fashion item”, says UK-based influencer Andrea Cheong, who recently shared an “underconsumption core” style video of her mending old clothes.

It is an addiction tied to a pressure “to articulate who we are through possessions”, Cheong notes.

The social media trend of ‘underconsumption’ is another way for Gen Z to make the most of their money and be environmentally friendly at the same time

In contrast, “underconsumption core” breaks from traditional core trends promoted by influencers, who often sell an ever changing purchasing blueprint embodying the latest trend and aesthetic, according to Cheong. She and Makoni agree that the shift also reflects increased calls for authenticity from content creators.

Now, “conserving is cool”, says Makoni – “we saw very similar patterns after 2008” during the financial crisis.

Over half of Gen Z adults – age 18 to 27 – polled in a 2024 survey by Bank of America stated the high cost of living as a top barrier to their financial success, adding that many do not make enough money to live the life they want.

“The social media trend of ‘underconsumption’ is another way for Gen Z to make the most of their money and be environmentally friendly at the same time,” says Ashley Ross, head of consumer client experience and governance at Bank of America.

While younger generations worry about making sustainable choices, a lack of financial autonomy drives their decisions.

“Let’s be honest, no one’s gonna change their GDP [gross domestic product] for sustainability. We don’t live in that world … the motivation for people to do these things has always been to save money,” says Cheong.

She says “underconsumption” trends ultimately provide the most accessible approach to sustainability for those who seek it.

The message is simple: “Buy less, buy better.”