KEY POINTS

- The Democratic presidential nominee says this would be provided to more than four million people over four years if she were to occupy the Oval Office.

- In May, national home prices were up 48 per cent from four years earlier, according to Case-Schiller.

- Today marks the fourth and final night of the Democratic National Convention, during which presidential nominee Harris is expected to speak.

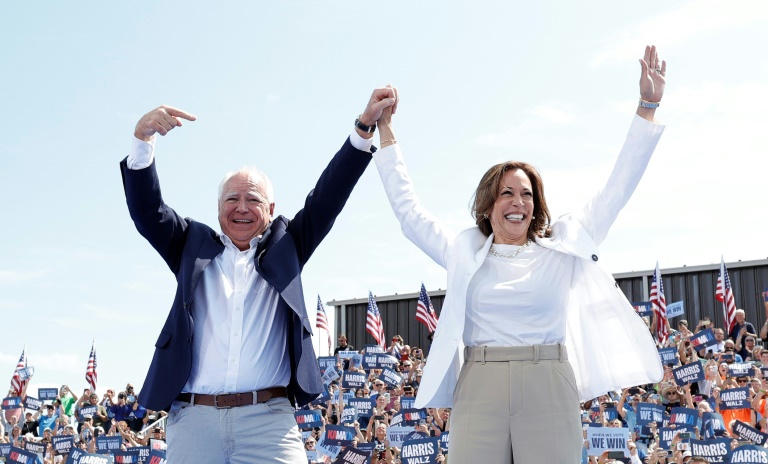

Vice President Kamala Harris recently unveiled a comprehensive set of housing policy proposals, providing voters with a glimpse of what the U.S. housing market might look like under a Harris administration. Her plan, which marks her first major policy announcement since replacing President Joe Biden as the Democratic nominee for the 2024 presidential race, has sparked a significant debate among economists, political analysts, and industry experts.

A Bold Housing Proposal

Harris’s proposal centres on offering up to $25,000 in federal down payment assistance to first-time homebuyers who have consistently paid their rent on time for at least two years. This ambitious plan significantly expands upon President Biden’s earlier proposal of a $10,000 tax credit for first-time buyers, which was limited to first-generation homebuyers.

Under Harris’s plan, the $25,000 assistance would be available to all first-time homebuyers across the nation, potentially benefiting more than four million people over four years. The proposal also includes a tax credit for builders to encourage the construction of affordable starter homes, restrictions on investor purchases of single-family homes, and a ban on shared software platforms used by landlords to set rent—practices critics have argued contribute to price-fixing in the rental market.

Divisive Reactions

The announcement of Harris’s housing plan has elicited mixed reactions. On one hand, some housing advocates see the proposal as a necessary intervention to address the growing affordability crisis. On the other hand, critics argue that the plan could exacerbate existing economic challenges.

Alexander Gorlin, an architect and co-author of Housing the Nation: Social Equity, Architecture, and the Future of Affordable Housing, expressed cautious support for the plan. Speaking to FOX Business, Gorlin acknowledged that while $25,000 could provide meaningful assistance in some regions, it might not be sufficient in high-cost areas like San Francisco. He emphasised the importance of promoting homeownership and building equity, particularly through the purchase of starter homes.

However, not all experts share Gorlin’s optimism. Tony Fiorillo, owner of Asset Management Strategies, Inc., criticised the proposal, describing it as a “perfect formula to create inflation.” Fiorillo warned that providing government-funded down payment assistance would drive up demand for homes at a time when the supply is already limited, potentially leading to higher home prices and further reducing the availability of affordable housing. Elon Musk echoed this concern, agreeing with a comment on X (formerly Twitter) that suggested the plan would increase home prices by $25,000 while also adding to the federal deficit.

The Broader Economic Impact

Critics have also raised concerns that Harris’s proposal is more about political strategy than sound economic policy. Cody Moore, a partner and wealth adviser at Wealth E&P in Alpharetta, Georgia, described the plan as a “terrible policy” aimed at garnering votes through government handouts. Moore warned that the plan could further inflate the real estate market, deepen the national deficit, and lead to higher taxes in the future.

Despite these criticisms, Harris has defended her proposal as a necessary step to address the widening gap in homeownership. In a speech delivered in North Carolina, she highlighted the sharp rise in housing prices over the past few years, noting that national home prices had increased by 48% since 2019, according to Case-Schiller data. Harris argued that as home prices have risen, so too have the size of down payments, making it increasingly difficult for aspiring homeowners to save enough to buy a home. “Even if aspiring homeowners save for years, it often still is not enough,” she said.

The Feasibility of Harris’s Plan

Beyond the down payment assistance, Harris’s housing proposal includes a broader agenda aimed at increasing the nation’s housing supply. She has set a goal of constructing three million new housing units over her potential four-year term, a target that aligns with the U.S. Census Bureau’s report of 1.5 million new privately constructed housing units completed in 2023 alone. However, key elements of her plan, including the down payment assistance, would require congressional approval, raising questions about the feasibility of these proposals.

The nonprofit policy group Committee for a Responsible Federal Budget estimates that Harris’s housing policies could cost $200 billion over four years, with potentially higher costs if the programs were made permanent. This has further fuelled the debate over the long-term economic implications of such expansive government intervention in the housing market.

Political and Social Reactions

The proposal has also become a point of contention in the 2024 presidential race. The Trump campaign quickly criticised Harris’s plan, with Republican vice presidential candidate J.D. Vance accusing her of wanting to give “$25,000 to illegal aliens to buy American homes”—a claim that plays into the broader political narrative surrounding immigration and homeownership. It remains unclear whether Harris’s plan would require citizenship, as traditional or “conforming” mortgages are not available to undocumented immigrants.

Despite the controversy, Harris has received some support from housing advocates. The National Association of Home Builders praised her focus on increasing the nation’s housing supply, with NAHB Chair Carl Harris stating, “The primary way to tackle the nation’s housing affordability crisis is to increase the nation’s housing supply.”