For representative purposes.

| Photo Credit: iStockphoto

The financial relationship between the Union government and the States in India is asymmetrical, as in many other countries with a federal constitutional framework. As the 15th Finance Commission noted, States incur 61% of the revenue expenditure but collect only 38% of the revenue receipts. In short, the ability of the States to incur expenditures is dependent on transfers from the Union government. Consequently, there is the problem of Vertical Fiscal Imbalance (VFI) in Indian fiscal federalism where expenditure decentralisation overwhelms the revenue raising powers of the States.

Why should VFI be reduced?

Constitutionally, the financial duties of the Union government and the States are divided. On the revenue front, to maximise the efficiency of tax collection, the Personal Income Tax, the Corporation Tax and a part of indirect taxes are best collected by the Union government. But on the expenditure front, to maximise the efficiency of spending, publicly provided goods and services are best supplied by the tier of the government closest to its users. It is in this context that the extent of VFI merits attention.

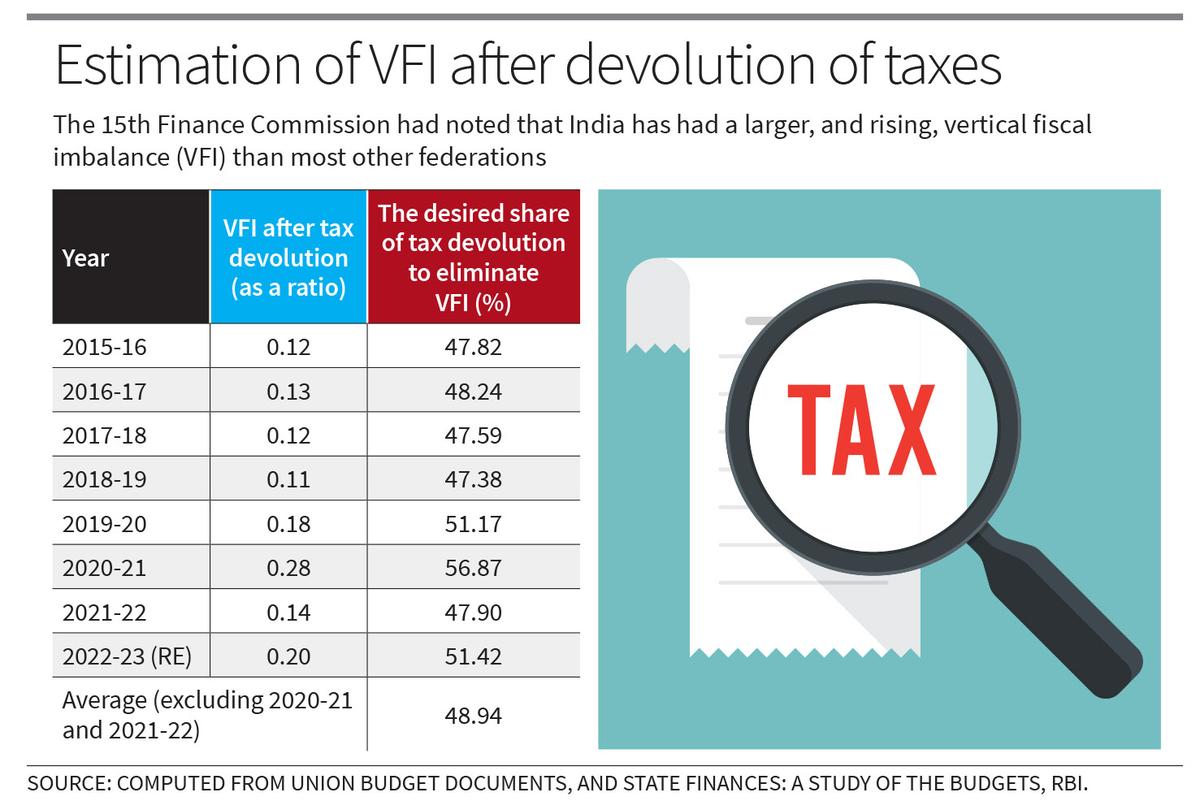

The 15th Finance Commission had noted that India has had a larger, and rising, vertical imbalance than most other federations. These imbalances were further magnified during periods of crises, such as the COVID-19 pandemic, which drove a large wedge between one’s own revenues and expenditure responsibilities at the sub-national level.

The problem of VFI falls under the purview of the Finance Commission, and it deals with broadly two questions. The first question is how to distribute the taxes collected by the Union government to the States as a whole. These transfers are made as a prescribed share of the “Net Proceeds” (Gross Tax Revenue of the Union less surcharges, cesses and costs of collection). The second question is how to distribute taxes across States. The matter of VFI arises as part of the first question.

Apart from devolving taxes, the Finance Commissions also recommend grants to States in need of assistance under Article 275 of the Constitution. But these are generally for short periods and for specific purposes. There are also transfers to the States that fall outside the Finance Commission’s ambit. For example, the Union government spends substantial amounts — under Article 282 of the Constitution — on subjects falling in the State and Concurrent lists through centrally sponsored schemes and central sector schemes. But such grants are tied transfers that include conditionalities. In sum, the devolution of taxes from the net proceeds is the only transfer to the States that is untied or unconditional.

Calculating VFI in India

Here we try to estimate the VFI in India after the devolution of taxes to the States. We measure VFI at the level of “all States”, and not separately for each State. For this, we use a globally accepted method. We first estimate a ratio where the numerator is the sum of the Own Revenue Receipts (ORR) and the tax devolution from the Union government for all States. The denominator is the Own Revenue Expenditure (ORE) for all States. If this ratio is less than 1, it implies that the sum of own revenue receipts and tax devolution of the States is inadequate to meet the ORE of the States. If we subtract this ratio from 1, we get the deficit in receipts. It is this deficit that we use as a proxy for VFI after devolution.

We can then ask the simple question: how much should tax devolution rise over and above that recommended by the past Finance Commissions to equalise the ratio to 1? Equating the ratio to 1 would eliminate VFI. In the attached table, we show that the average share of net proceeds devolved to the States between 2015-16 and 2022-23 should have been 48.94% to eliminate the VFI. But the shares of tax devolution recommended by the 14th and 15th Finance Commissions were only 42% and 41%, respectively, of the net proceeds.

Raising tax devolution

Many States have raised the demand that the share of tax devolution from the net proceeds must be fixed at 50% by the 16th Finance Commission. They add force to this demand by pointing to the exclusion from the net proceeds of the substantial amounts of cesses and surcharges, which truncates the net proceeds within the gross tax revenue.

Our analysis in this article lends empirical support to this demand. Here, we have assumed the present levels of expenditures of the States as a given. At the aggregate level, these actually incurred expenditures have not only conformed to but also underutilised the borrowing limits specified in the fiscal responsibility legalisations. Even then, we find that the share of net proceeds devolved to the States must rise to about 49% to eliminate VFI. Such an increase in devolution would place more untied resources in the hands of the States to spend on their citizens. It would also ensure that States’ expenditures better respond to jurisdictional needs and priorities, and that the efficiency of expenditures is enhanced. Overall, it will be a move towards a healthy system of cooperative fiscal federalism.

R. Mohan is former Indian Revenue Service officer. R. Ramakumar is Professor, Tata Institute of Social Sciences, Mumbai.

Published – September 06, 2024 08:30 am IST