SINGAPORE: The head of Mediacorp’s Chinese news team and a former news veteran at Singapore Press Holdings (SPH) daily Lianhe Zaobao are being sued by a businessman, who wants a purported loan of S$990,000 (US$740,500) to be returned to him.

Mr Ren Xin Wu had given the sum to Mediacorp’s Chua Chim Kang and Ms Lee Kuan Fung purportedly as working capital for Homing Holdings, a holding company for two businesses that provided tuition and specialised in Mandarin-language programmes and events.

Mr Ren claims that the amount was repayable in three years from 2017 when it was given, but Mr Chua and Ms Lee’s lawyers allege there was no such agreement.

It is also alleged that in 2020, when the business was in dire straits, Ms Lee paid S$40,000 in Homing Holdings funds to a third-party company called Goldciti.

The company was introduced to her by Mr Chua, and the sum was purportedly for consulting services.

The suing parties claim that this transaction was a sham one, with the intention being to funnel funds out of Homing Holdings and allow the business to avoid paying creditors.

At the same time, liquidators for Homing Holdings, which has failed, are suing Ms Lee for allegedly breaching her fiduciary duties as director of the company, with Goldciti as a second defendant.

The civil trial for the two suits opened in the High Court on Tuesday (Nov 12), with lawyers for Mr Chua and Ms Lee refuting the claims, asking for them to be dismissed and saying that there is a lack of evidence in the case.

BACKGROUND OF THE CASE

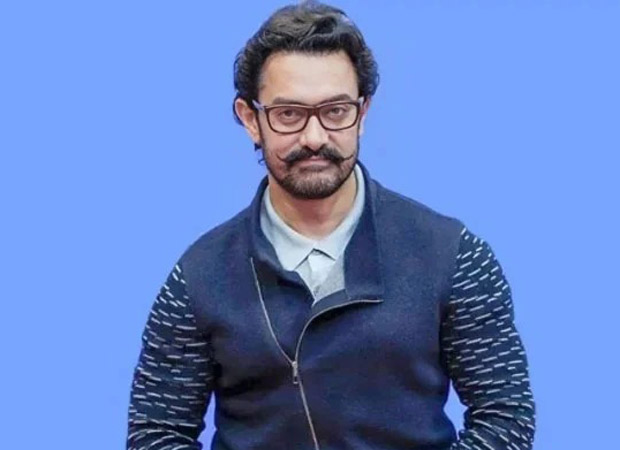

Ms Lee is a news veteran who spent 18 years at SPH before leaving in May 2017, according to her LinkedIn profile. Mr Chua is currently the head and chief editor of Chinese news and current affairs at Mediacorp and also heads the company’s Youth Editorial initiative.

Mediacorp is also the parent company of CNA.

He joined Mediacorp in 2018, but was previously from SPH, holding roles such as managing editor of its Chinese Media Group.

The pair are being defended by Mr Muthu Kumaran Muthu Santhana Krishnan from Kumaran Law and instructed counsel Mr Salem Ibrahim.

According to the defendants’ opening statement, Mr Ren, a Chinese citizen and Canadian resident, first met Mr Chua in 2015, when Mr Chua was an executive with SPH.

At the time, Mr Chua had been in the media industry for about 15 years. Over a social lunch, Mr Ren mentioned that he wanted to promote and raise the profile of an event for China Minsheng Investment Group, the defence said.

In the capacity of his role at SPH, Mr Chua then introduced Ms Lee to Mr Ren, as she was in a position at SPH where she could assist him with his goals.

According to Ms Lee’s public LinkedIn profile, she was deputy editor of the Central Integrated Newsroom and later assistant vice-president of Lianhe Zaobao handling “new growth” in 2015.

Mr Ren later had a successful project with SPH, said the defence in its opening statement.

The trio later met to celebrate the success and had subsequent lunches, where Mr Ren purportedly persuaded the two news veterans to start a business with him.

Homing Holdings was incorporated in June 2017. It was the holding company for the operating companies Luminaries Holdings and Lulele Learning Space.

Luminaries was formed to promote the use of Mandarin by acquiring kindergartens and preschools, providing Mandarin-language programmes and managing events and concerts.

Lulele was an educational business focusing on academic tutoring and tuition matching services.

“Chua was established in his new job and happy with it. Indeed, he never took a full-time or an active role in Homing. On the other hand, Lee took the plunge,” said the defence.

The lawyers claimed that Mr Chua had no desire to be involved in the day-to-day management of the business and did not participate or have shares in it, but Mr Ren purportedly insisted that Mr Chua be given a 35 per cent stake.

Those shares were eventually held by Ms Lee, who was also a director of the subsidiary companies, the defence said.

According to the defence, Mr Ren wanted Ms Lee to leave her employment with SPH and go full-time, and this came to fruition.

Business was initially healthy, but revenue dived when COVID-19 hit in 2020, the defence said.

“Ren became unhappy and soon wanted his S$990,000 he had invested in Homing as a convertible loan to be returned to him,” said the lawyers.

WHAT MR REN, HOMING HOLDINGS ARE SEEKING

Mr Ren and Homing Holdings, which is in compulsory liquidation, are represented by Mr Harry Zheng Shengyang and Ms Jasmin Kang from Kelvin Chia Partnership.

In her opening statements, Ms Kang said her case was that Ms Lee had caused Homing Holdings to enter into a sham agreement with Goldciti to siphon funds from the former.

Homing Holdings is seeking to recover the sum of S$40,000 paid under the alleged sham agreement for services that were never rendered, and to hold Ms Lee liable for breaching her fiduciary duties as director of the company.

Ms Kang’s case is also that Ms Lee had conspired with Goldciti to defraud Homing Holdings and caused it to suffer a financial loss.

Ms Kang said she will show at trial that Ms Lee had failed to keep proper company records, and that she and Goldciti were “repeatedly evasive” in communications with liquidators.

For the second suit mounted by Mr Ren, Ms Kang said her client had provided the interest-free loan of S$990,000 to Homing Holdings for working capital for a term of three years.

The company had to repay the loan after three years, or parties could have negotiated an extension, reached a separate agreement on repayment, or converted the loan into equity.

However, when the loan was due, Ms Kang alleged that Ms Lee and Mr Chua failed, refused or neglected to get the loan returned, in breach of their agreement with Mr Ren.

Citing the defence’s claim that Mr Ren had used “all sorts of tactics to pressure” them into repaying the loan, Ms Kang said Mr Ren was entitled to expect repayment and had sought it.

The so-called harassment alleged by the defence was “nothing more than Mr Ren enforcing his legal rights”, said Ms Kang.

Lawyers for Ms Lee and Mr Chua referred to a letter of demand issued by Mr Ren’s lawyer, Mr Zheng, which was openly pasted on the wall next to the door of Ms Lee’s home in 2020.

Ms Lee filed a complaint with the Law Society of Singapore (LawSoc) over this, and Mr Zheng was sanctioned.

But Ms Kang said this argument was “nothing more than a smokescreen” and a red herring. As LawSoc had already found that Mr Ren’s lawyer did not intentionally cause embarrassment to Ms Lee, or intentionally indulge in unfair conduct.

“The conduct that Ren’s solicitor was sanctioned with a warning for, was for unthinkingly posting the demand on Lee’s front door without first placing the letter into an envelope,” said Ms Kang.

She said she would show in the course of the trial that Ms Lee and Mr Chua had agreed “by their conduct” that they were bound by the terms of the agreement.

They had agreed to get the company to return the loan to Mr Ren, but failed to do so, Ms Kang charged.

Mr Chua had purportedly agreed to repay the loan personally, but also failed to do so, said the lawyer.

These actions caused Mr Ren to suffer loss and damage, said Ms Kang.

She is seeking a return of the S$990,000 to Mr Ren by Ms Lee and Mr Chua and a declaration that Ms Lee had caused Homing Holdings to enter into agreements with other companies to Homing Holdings’ detriment.

In the alternative, she asked for damages to be assessed against Ms Lee, with interest and costs.

Mr Salem, who is acting in the suit against Ms Lee and Mr Chua, said Mr Ren’s case will not be borne out by any of the documentary evidence before the judge.

He said he would assist the court through cross-examination and not “allegations or bald statements”.

He said Mr Ren “will not be able to run away from what he said in the emails or in the WhatsApp exchanges”, alleging that there was a “set-up” in order to get Mr Chua to agree in a recorded conversation that he would pay for the loan and mortgage his property.

Mr Salem said this case was “an abuse of process”, and that company revenues fell across the board during the COVID-19 pandemic, with many companies still suffering its effects even today.

Even if there were evidence of negligence of breach of fiduciary duty by Ms Lee, it is not something Mr Ren should be suing for, but for the company in liquidation to make a complaint over, said the lawyer.

The trial continues.