A new study suggests that a combination of climate-related disasters, inflation, and rising new car prices could surge insurance premiums this year.

Increased repair costs put pressure on insurers, leading to legislative activity and rate approvals that triggered significant car insurance premium hikes in early 2024. A report from Insurify revealed a 28 percent increase in the cost of full coverage car insurance nationwide between June 2023 and June 2024. Still, drivers in certain states faced even steeper rate hikes – some surpassing 50 percent.

Car insurance rates are skyrocketing in several states, including Minnesota, Missouri, North Carolina, Illinois, and California. Rising repair costs, natural disasters, and increased theft rates drive these dramatic increases.

Minnesota saw a rate hike of over 50 percent after severe storms, while Missouri and Illinois suffered damage from hail and tornadoes. North Carolina’s coastal location makes it prone to hurricanes, resulting in higher premiums. Despite consumer protection laws, California has experienced significant rate increases due to rising claims and limited insurer availability.

Factors Driving Up Car Insurance Rates

The factors driving these extreme premium increases are diverse yet interconnected. In some states, shifting weather patterns due to climate change, such as hail and hurricanes, are driving up claims and, inevitably, premiums. Others are facing increased car theft or the consequences of legislative changes.

Minnesota, which experienced a 55 percent increase in insurance rates, suffered a total of $1.8 billion in damages following a myriad of severe storms that dropped golf-ball-to-baseball-sized hail across the Twin Cities in August 2023.

Screenshot / insurify.com

Last year, severe convective storms struck Missouri and northwest Illinois. According to the National Weather Service, a supercell produced golf ball-sized hail and heavy rains, forming a tornado as it moved across the states.

North Carolina is vulnerable to hurricanes, as demonstrated by Hurricane Idalia in 2023. Although it weakened to a tropical storm, the hurricane led to damaging high winds, heavy rainfall, and local flash flooding.

These storms can cause water damage to cars, which insurers cover if the drivers have comprehensive coverage. Additionally, Car thefts contribute to rising premiums. Missouri and California rank among the ten states with the highest rates of auto theft per capita, and Illinois had the fifth-highest number of stolen cars in 2023, according to NICB data.

In July, a Minnesota woman, Erin Walters, reported that several major car insurance companies, including State Farm and Progressive, refused coverage due to the lack of anti-theft technology in her 2019 blue Hyundai.

California’s Consumer-Focused Regulations

Despite California’s insurance regulations prioritising consumer protections and requiring approval from the Department of Insurance (DOI) before insurers can implement rate increases, drivers in the state still saw a 45 percent year-over-year increase in full-coverage rates in the past year.

“During COVID-19 shutdowns, states like California put a freeze on rate increases. That’s why so many people saw drastic rate hikes in 2023 after those restrictions were lifted,” said Mallory Mooney, a licensed insurance agent and director of sales and service at Insurify.

Screenshot / insurify.com

“Insurers are still playing catch-up, and it’s too little too late for a lot of them. Insurers have had to pull out of some markets completely,” Mooney added.

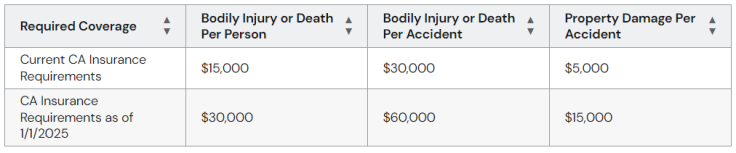

Adding to the complexities, California is raising its minimum car insurance requirements to match those of other states. In late 2022, Governor Gavin Newsom signed Senate Bill 1107 into law, doubling and, in some cases, tripling the liability limits for auto insurance policies. The changes will take effect on January 1, 2025.

In other words, California residents can expect even higher premiums next year. On the bright side, they will benefit from increased protection limits. The higher limits will help prevent more drivers from incurring debt after a car accident, but insurers will likely raise rates to compensate for the increased financial burden.

While beneficial to policyholders, California’s consumer protection laws complicate insurers’ ability to operate profitably. The state’s Department of Insurance (DOI) doesn’t act in haste regarding rate hikes.

Some insurers have responded by exiting the state. GEICO has closed all of its California offices, State Farm has stopped quoting policies by phone, and Progressive has ceased advertising in the state.

With more insurers exiting the state, the DOI may approve further rate increases to maintain market competition. As a result, it is becoming more challenging for Americans, particularly in the ten most expensive US states for car insurance, to keep their vehicles on the road.