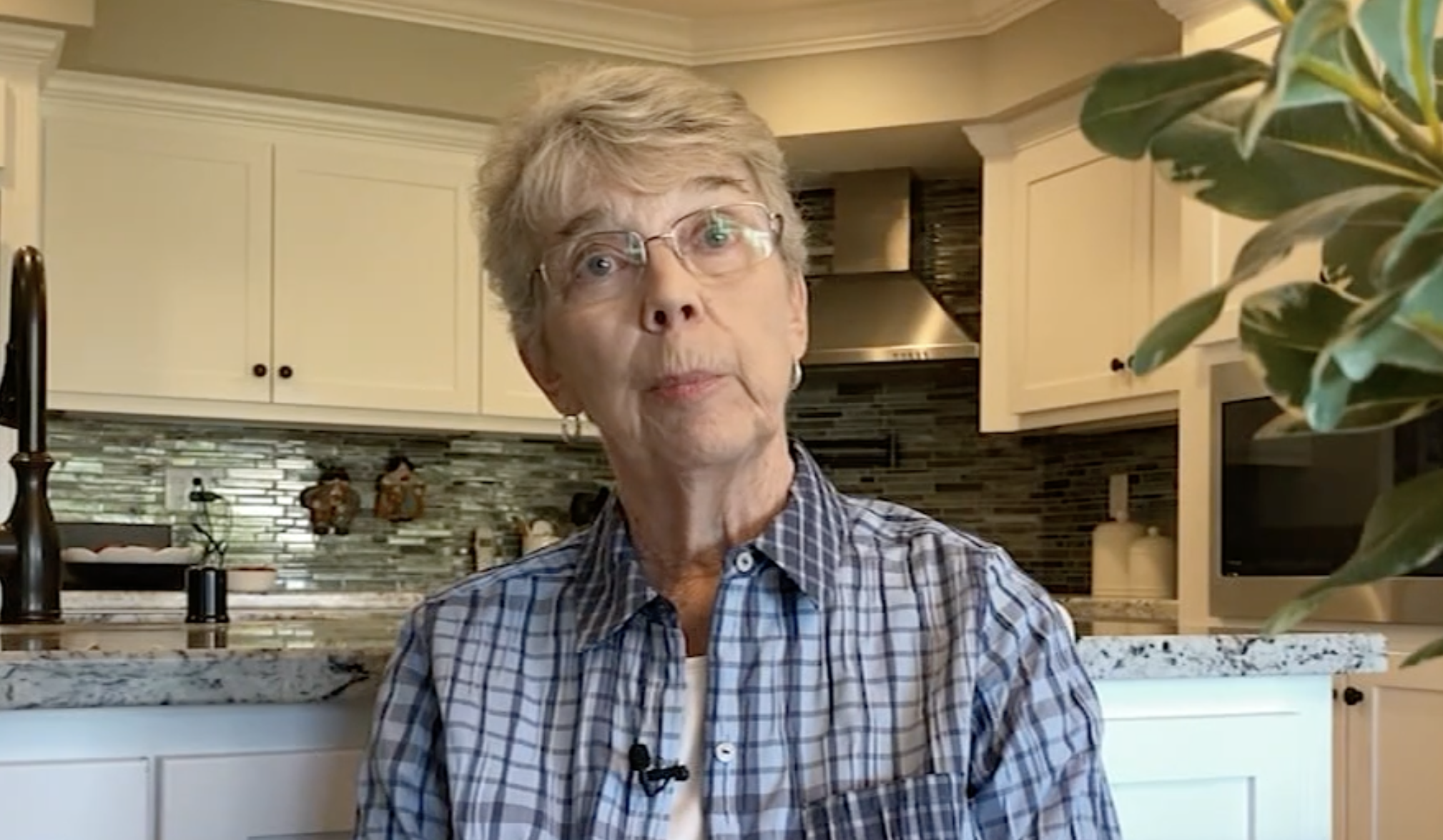

Lois, an 83-year-old San Francisco Bay Area resident, recently lost $50,000 in a sophisticated cryptocurrency scam after falling victim to a “grandson in trouble” ruse. Lois, returning home late on a Friday evening, received a frantic call from a man claiming to have her grandson, stating that he was in trouble. Moments later, another voice, posing as her grandson, tearfully explained that he had been arrested for causing an accident while under the influence. The caller convinced Lois to keep the situation secret and instructed her to pay for his bail using Coinstar cryptocurrency ATMs, claiming that court protocols now allowed for payment via digital currency for faster processing.

According to Lois, she was distressed and willing to help her grandson, believing she had no choice but to comply with the caller’s urgent requests. The scammers led her to multiple Coinstar ATMs, where she inserted $100 bills as instructed, with each $10,000 deposited into what she thought was her grandson’s bail account. “He told me the court devised a way for people to pay for bail because checks take too long. He said, ‘We have an account with Coinstar,'” she recounted to ABC7 News’ 7 On Your Side team.

Repeated Requests for Cash With Increasingly Distressing Claims

Lois deposited $9,500 in her first round of payments, following each step of the caller’s instructions. But by the next day, the caller was back, alleging that additional charges had been filed and that the bail had increased due to the alleged victim suffering a miscarriage from the accident. She was asked to provide an additional $15,000. Desperate and scared, Lois once again went to the Coinstar ATM, feeding $100 bills into the machine, unaware she was being deceived. “It took me over an hour each time, and every $10,000, it prints a receipt,” she said. After a total of $25,000 had been sent, Lois received a final call demanding another $25,000, allegedly for attorney fees and additional court costs.

The heart-wrenching situation left Lois feeling cornered, believing she had to keep paying to ensure her grandson’s safety. “What was I to do, just say, ‘Oh, I’m going to abandon him’? I couldn’t do that,” she explained.

Bank Warnings and Bystander Intervention

Lois’s bank raised red flags regarding her withdrawals, concerned about the unusually high cash transactions, which deviated from her regular spending pattern. When bank staff asked Lois about her withdrawals, she attempted to dispel their concerns by claiming she was purchasing items at an estate sale that required cash. In addition to bank alerts, Coinstar machines also issued prompts advising her to verify her transactions. Yet, her fear and anxiety over her grandson’s safety kept her from questioning the process.

It wasn’t until a passerby at the Coinstar machine noticed Lois’s prolonged activity and urged her to double-check the caller’s claims that she considered contacting her grandson directly. Only then did she text him and find out he was safe and unaware of any incident. Realising she had been deceived, she immediately informed her daughter, Lisa, who joined her in the painful process of reporting the scam and attempting to recover the funds.

Recovery Challenges in Crypto Transactions

Upon realising the scam, Lisa contacted Coinstar, hoping to trace or retrieve the funds, but quickly learned the harsh reality of dealing with cryptocurrency. It took several days to reach Coinstar’s support team, only to be informed that the funds were likely unrecoverable due to the irreversible nature of cryptocurrency transactions. The support team explained that once funds are moved from a Coinstar machine into a digital wallet, they can be quickly transferred and withdrawn, making recovery almost impossible.

Unlike traditional bank transactions, which can sometimes be reversed, cryptocurrency is decentralised, with transactions verified by complex cryptographic algorithms on a public ledger known as the blockchain. While blockchain technology allows for transparency and innovation in financial services, it also presents unique challenges in recovering funds in fraud cases. According to Coinstar, the scammers’ accounts were closed, and they could not provide further assistance.

Reflecting on her experience, Lois advised families to establish a “safe word” for use in emergencies to verify the legitimacy of such situations. “This way, if someone calls with an unlikely story, you have a way to check,” she said, hoping to prevent others from enduring similar heartbreak.

Growing Wave of Crypto Scams

The rise in cryptocurrency use has also increased crypto-related scams, with fraudsters employing sophisticated tactics to exploit unsuspecting individuals. From impersonation schemes to synthetic identity theft, scammers leverage both emerging technologies and stolen personal data to prey on vulnerable individuals. According to the Federal Trade Commission, more than 500,000 identity theft cases were reported in the first half of this year, many involving financial scams that utilise cryptocurrency.

The incident highlights the growing risk associated with cryptocurrency payments, particularly for those unfamiliar with digital finance. In cases like Lois’, where her lack of experience with crypto technology contributed to the scam, cryptocurrency’s rapid transfer and anonymity make it nearly impossible to recover stolen funds. Authorities urge caution and advise individuals to verify the identity of any caller asking for money and to question any transaction that involves unconventional payment methods.