Social Security Retirees Expecting 2025 COLA Increase Should Do This By November 20

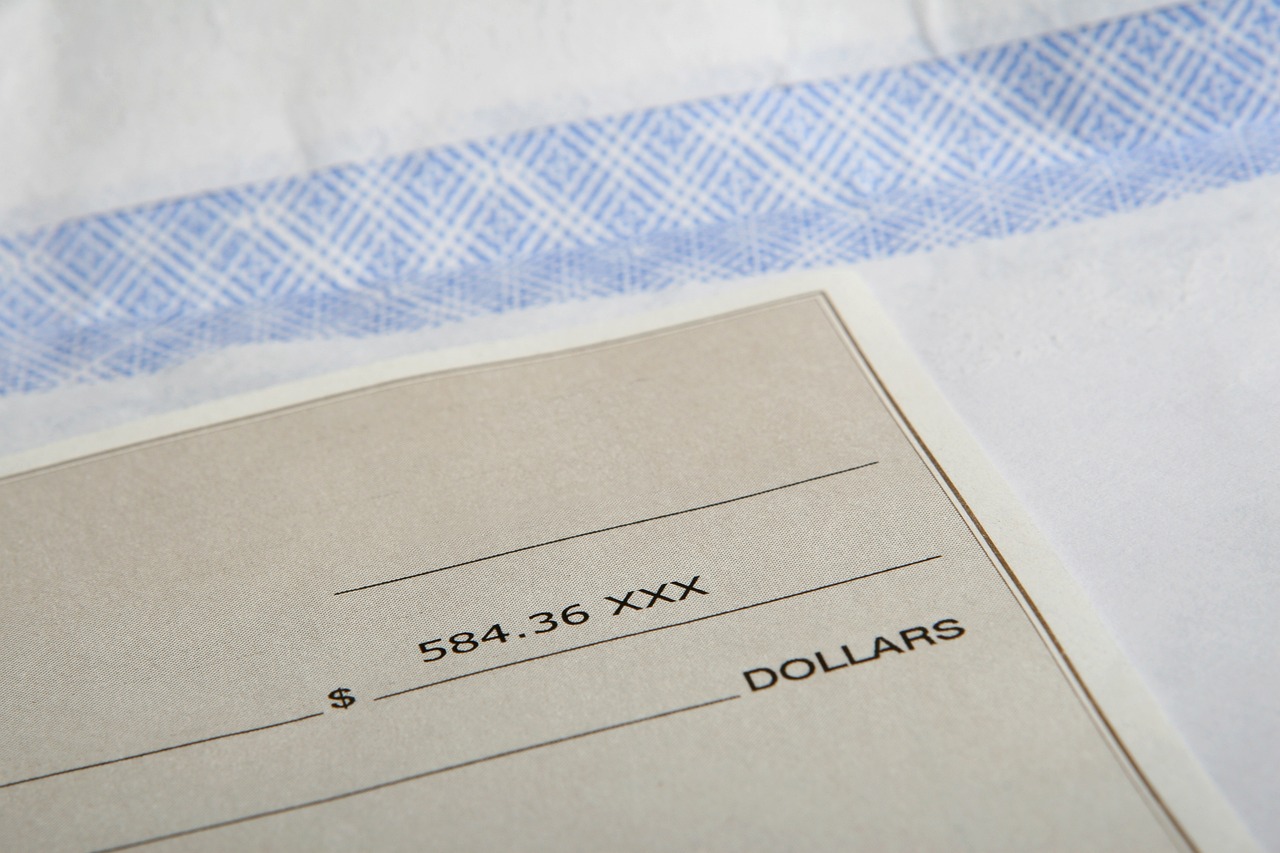

Over 72.79 million Americans received some form of Social Security benefit in October, where the average monthly benefit stood at $1,787.08. The Social Security program serves as a crucial source of income for more than 54.15 million retirees across the country. While Social Security is designed to support retirement income levels, beneficiaries increasingly rely on … Read more