In a recent interview on YouTube, Rich Dad Poor Dad author Robert Kiyosaki said that the US Federal Reserve has been buying gold for almost a year now, likely because of the spiralling national debt of nearly $36 trillion, which is accruing interests of over $1 trillion for the first time in history. Kiyosaki believes the central bank is in trouble, given that the US put on more debt in a year than it took “in the first 200 years” and that the country has been trying to solve this problem by printing more money and dropping interest rates. The multi-millionaire explained that the government “can’t keep getting into debt” and pay for it with “fake money.”

Kiyosaki has long advocated for assets like precious metals, including gold and silver, because of their high exchangeability, universal demand, limited supply, and negative correlation to stock markets. Gold has been a sign of wealth since ancient times. It remains a top investment pick as it doesn’t face devaluation like fiat currencies and has historically surged in record prices during market upheavals in the last half-century.

Gold’s intrinsic store of value also fuels value appreciation, making it a relatively safer asset for hedging against inflation. While gold prices hit successive record levels this year to soar above $2,790 per ounce, the asset experienced a sudden pullback after President-elect Donald Trump’s election win. However, experts believe the Trump Administration could also aid gold prices in the future, which was trading at $2,597 per ounce on November 18.

Goldman Sachs Sees Gold Prices Reaching $3,000 Per Ounce

Goldman Sachs analysts believe gold will break more records next year on the back of the Fed’s gold-buying spree and interest rate cuts. The Wall Street giant named gold among next year’s top commodity trades with the potential to extend gains under Trump’s rule. In a recent note, Goldman Sachs analyst Daan Struyven urged investors to “go for gold” and maintained a target price of $3,000 per ounce for December 2025.

The banking analysts explained that their projections were founded on the rising demand for the metal from the Fed alongside a cyclical lift fueled by flows to exchange-traded funds (ETFs) amid rate cuts as the central bank plans to simplify policies. Furthermore, Goldman Sachs experts opined that potential trade tensions and looming risks around US fiscal sustainability could also aid gold prices.

Geopolitics Is A Key Driver Of The Gold Rally

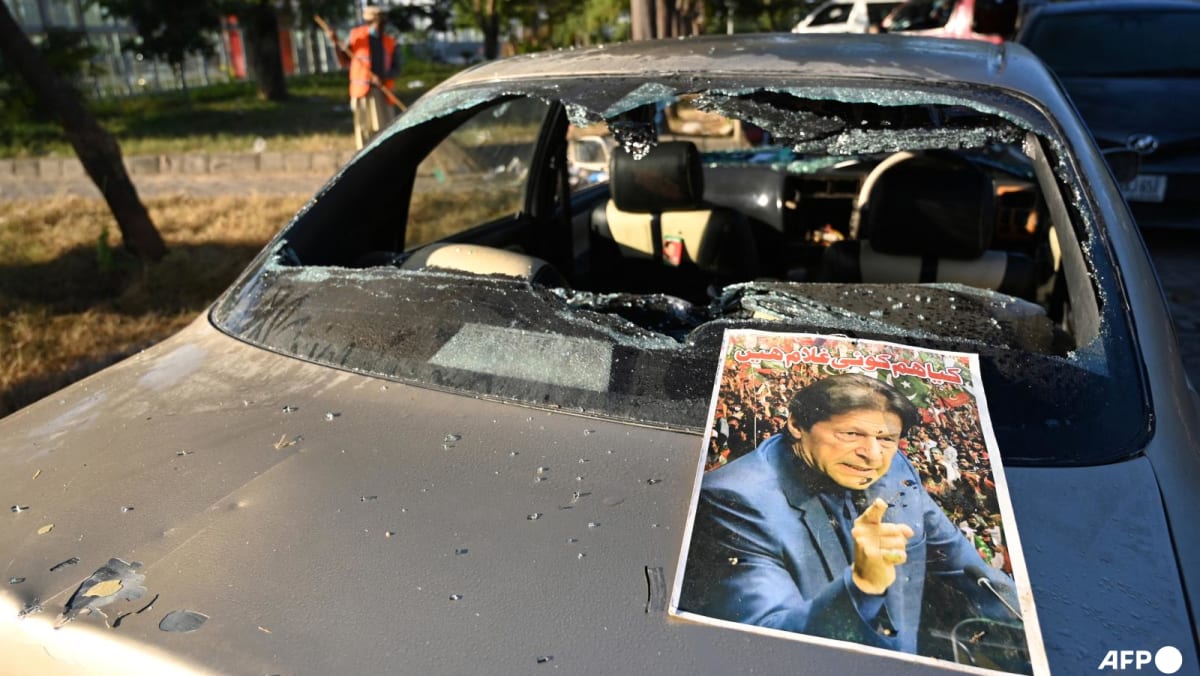

Investors have always viewed gold as a safe haven in times of global conflicts, threatening to derail crucial supply chains and economic progress. The Israel-Hamas war and Russia’s invasion of Ukraine have dangerously escalated this year to spark risks of a global war as more countries are getting pulled into these regional conflicts.

While Ukraine President Volodymyr Zelenskyy remarked that Trump’s presidency could end its years-long war with Russia much sooner than expected, US President Joe Biden yesterday authorised the Ukrainian armed forces to use US-supplied long-range missiles, called the Army Tactical Missile Systems (ATACMS), for strikes inside Russia as they defend their forces against Russian and North Korean troops in the Kursk region of Russia. With no end to these volatile wars, gold prices continue to face upward price pressures globally.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.