Mortgage rates dipped for the second week in a row, according to the Mortgage Bankers Association, stirring an avalanche of refinance borrowers.

Refinance applications jumped 35% in a week, the Mortgage Bankers Association reported.

“Rates on both 30- and 15-year fixed rate mortgages decreased for the second consecutive week, and combined with the previous week’s rate moves, spurred another strong week for application activity as borrowers with higher rates took the opportunity to refinance,” said Joel Kan, vice president, deputy chief economist at the Mortgage Bankers Association.

Overall applications are up almost 17% to the highest level since January 2023, driven by a 35% increase in refinance applications, Kan said.

MBA reported the refinance index also saw its strongest week since May 2022 and was 117% higher than a year ago, driven by gains in conventional, FHA and VA applications.

Home purchase applications wre up 3%, with small gains seen across the various loan types, “indicating that prospective homebuyers are slowly reentering the market,” Kan said.

In another sign of good news, inflation fell to 2.9% for the first time since 2021.

It seems all but certain the Federal Reserve will drop short-term interest rates by one-quarter point or maybe even one-half point at its September meeting.

“The latest Bureau of Labor Statistics CPI (Consumer Price Index) report contained no major surprises, and a September rate cut from the Fed should be a done deal,” said Orphe Divounguy, a senior economist at Zillow. “Annual price increases measured by the consumer price index have fallen to 2.9% from 9% just two years ago. The markets still expect three quarter-point cuts by year’s end.”

Do you wait to pull the purchase or refinance trigger since short rates are expected to fall?

“In 2023, the 30-year fixed-rate mortgage nearly hit 8%, slamming the brakes on the housing market. Now, the 30-year fixed-rate hovers around 6.5% and will likely trend down in the coming months as inflation continues to slow,” said Sam Khater, the chief economist at Freddie Mac. “Lower rates are good news for potential buyers and sellers alike.”

But Divounguy has another view, thinking rates are close to bottoming out this year.

“The recent decline in Treasury yields, which mortgage rates tend to follow, reflects investors’ expectations, meaning mortgage rates may already be near their lowest point this year,” he said.

The 10-year Treasury rate is hovering at 3.93%. Its highest for the year was 4.7% on April 24. So, it’s down more than three-quarters of a point.

The highest rate this year for the Freddie Mac 30-year fixed was 7.22% on May 2. Last week, the 30-year came in at 6.49%, almost three-quarters of a point less than the May 2 figure. By the way, the lowest reading of the year was 6.47% on Aug. 8.

Previous history offers a simple solution to this timing dilemma. Get a no-cost refinance, and then do it again if you are confident rates will drop further. No cost means you pay a rate premium, but the lender absorbs the one-time costs in exchange. No-cost loans weren’t much more expensive than paying settlement charges. So, the math was pretty easy.

Recently, lenders have been raising their no-cost rates as a defense against serial refinancers doing this without paying points and spending any money.

For example, a no-cost rate today for a well-qualified borrower is 7.125%. The payment is $3,369 on a $500,000 mortgage. If you paid 1 point plus about $4,500 in hard costs (a total of $9,450) you could capture a 5.875% rate. The payment would be $2,958, a difference of $411. If you divide the $9,450 cost by the $411 savings, it would take 23 months to break even (not including the 1 point tax deduction over the life of the loan). Not bad.

My rule of thumb is if you can recoup your costs within three years or less and you don’t believe rates will drop significantly further, then it’s OK to pay the closing costs to buy the rate down — in this case to 5.875%.

Most borrowers who purchased in the last two years may already be in the 7% range. So, they might not be gaining anything through a no-cost loan over their current rate (needing a cash-out is a different question).

This is exactly what the lenders may be counting on.

If you can get 5.875% with some skin-in-the-game, rates would have to drop to the low 5’s or less for the math to make sense again. Lenders are more likely to retain the mortgage servicing over a longer period of time when borrowers pay money to buy the rate down in this market.

Fannie Mae and Freddie Mac allow cash-out to 80% of the property value. And they allow no cash-out refinancing to 95% of the property value. Cash-out refinances and no cash-out refis cost slightly more than purchase mortgages.

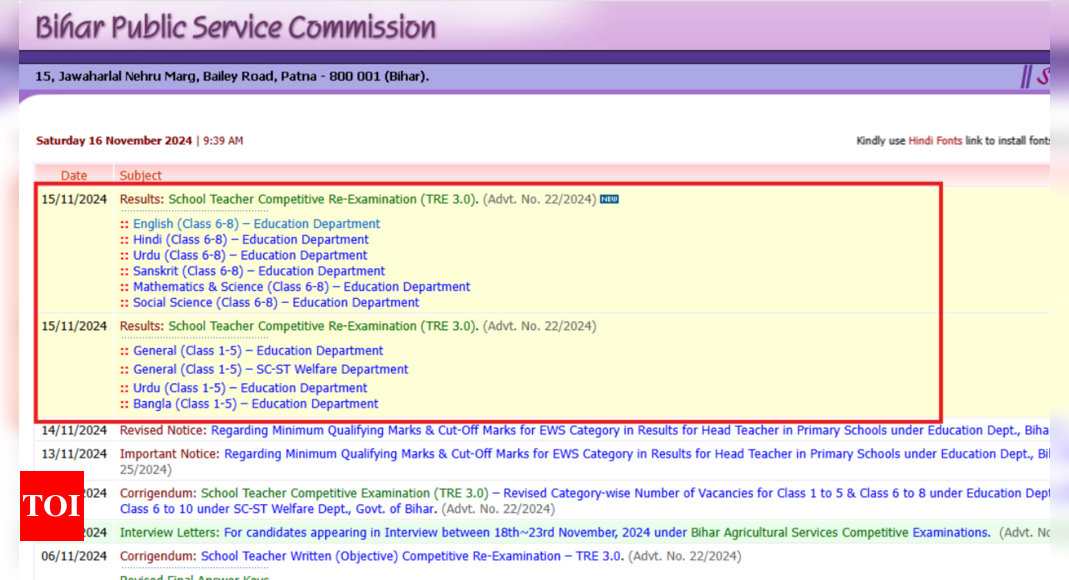

Freddie Mac rate news

The 30-year fixed rate averaged 6.49%, 2 basis points higher than last week. The 15-year fixed rate averaged 5.66%, 3 basis points higher than last week.

The Mortgage Bankers Association reported a 16.8% mortgage application increase compared to one week ago.

Bottom line: Assuming a borrower gets the average 30-year fixed rate on a conforming $766,550 loan, last year’s payment was $306 more than this week’s payment of $4,840.

What I see: Locally, well-qualified borrowers can get the following fixed-rate mortgages with one point: A 30-year FHA at 5.375%, a 15-year conventional at 5.25%, a 30-year conventional at 5.875%, a 15-year conventional high balance at 5.99% ($766,551 to $1,149,825 in LA and OC and $766,551 to $1,006,250 in San Diego), a 30-year-high balance conventional at 6.375% and a jumbo 30-year fixed at 6.625%.

Note: The 30-year FHA conforming loan is limited to loans of $644,000 in the Inland Empire and $766,550 in LA, San Diego, and Orange counties.

Eye-catcher loan program of the week: A 30-year fully amortized jumbo, fixed for the first five years at 5.875% with 30% down at 1 point cost.

Jeff Lazerson, president of Mortgage Grader, can be reached at 949-322-8640 or [email protected].

Originally Published: