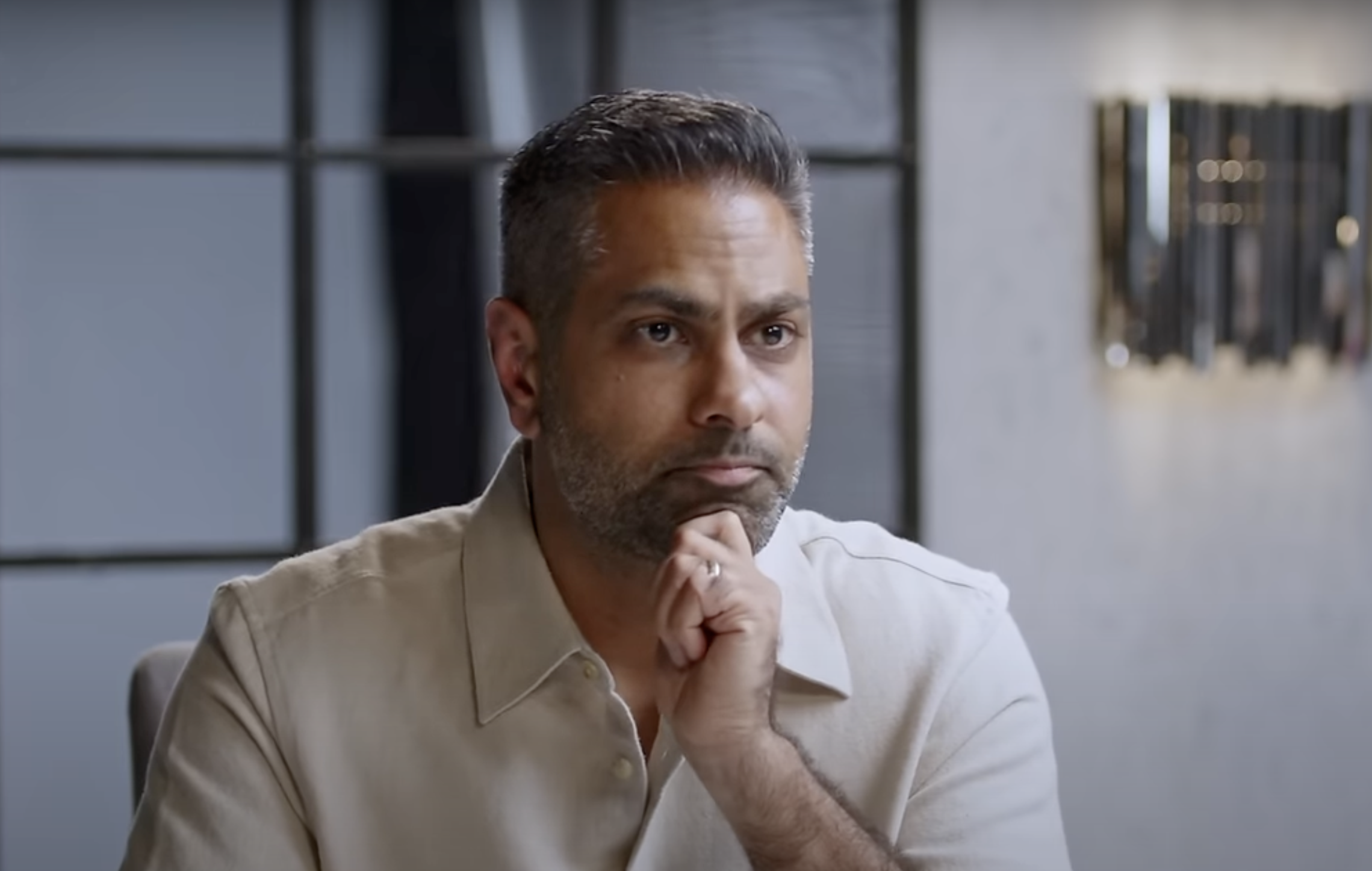

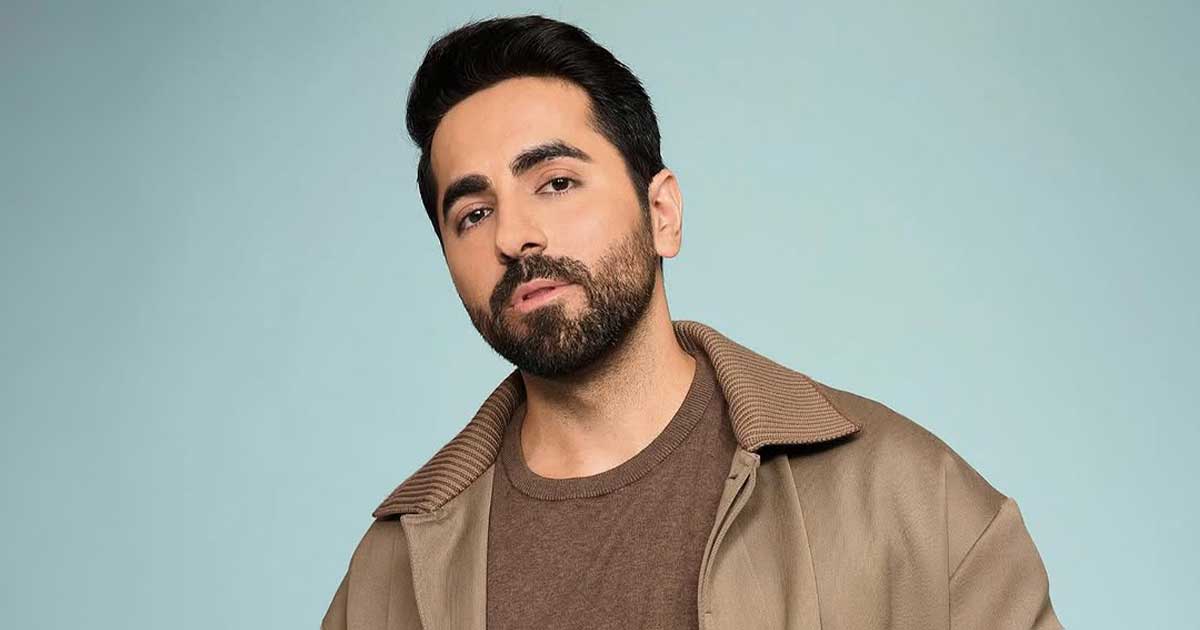

Netflix’s “How To Get Rich Show” host and multi-millionaire author Ramit Sethi recently shared his outlook on how money is central to relationships and ways to avoid financial pitfalls when dating in an interview with British entrepreneur and investor Steven Bartlett on the latter’s “The Diary Of A CEO” YouTube podcast.

The duo focused on an emerging trend of avoiding money talks and maintaining secrecy within relationships. While highlighting that money and infidelity are the top two reasons for divorces, Sethi explained that today’s money problems in relationships could be driven by women increasingly earning more than men, threatening their role as providers. He added that one can be a provider, nurturer, or helper because there are many ways to contribute to the household.

Regarding women having a secret bank account, Sethi recalled how, two generations ago, women weren’t allowed to open bank accounts. Hence, they might think of setting some money aside in case of unforeseen life events. However, the financial expert advised that one shouldn’t have a secret bank account. Instead, build a relationship where the partner doesn’t control the account or influence how you spend.

Who Should Pay On A First Date?

Sethi said it doesn’t matter who pays on a first date, but it could be a nice gesture if the person who proposed the date pays. He pointed out that most people focus on perfecting the first date rather than approaching it with thoughts for the future or trying to understand how the partner views money, just like focusing on the wedding and not the marriage. Dates have become a source of financial stress for Americans. A 2024 Self Financial survey found that almost 70% of the respondents are either uneasy about the cost of a date or experience anxiety over planning for a date. Furthermore, a Lending Tree 2022 survey found that one in five Americans avoided dating due to rising living costs.

However, most of those dating are willing to spend more to make it successful. Men spend an average of $67.87 per date, higher than the $56.61 women spend on dates, with millennials spending the most at 83. Sethi said what matters is if your partner is generous overall, which can be in many ways. While Bartlett and Sethi acknowledged that some women could privately feel it is a red flag if the partner asked them to pay on the first date, Sethi explained it is because culture is difficult to change, given that society portrays men as providers in many overwhelming ways.

Red Flags You Mustn’t Avoid In A Relationship

Sethi says the top financial red flag in a relationship is when a partner avoids talking about money. Partners can have diverging views on money and share different values. However, avoiding money talks can be a massive problem because “avoiders” don’t understand where money issues stem from and subsequently fail to understand their partner’s needs and wants around money. Meanwhile, optimisers “love to live in a spreadsheet,” but it can be a problem when they take it too far, overcalculating and continuously reevaluating financial goals they have already accomplished.

Sethi identifies another group of people as “worriers” who obsessively worry about money and generally pick it up from their parents, posing another red flag in relationships that can prolong impact for decades. Lastly, Sethi said there are “dreamers” who believe that success is one deal away and generally fall for get-rich-quick schemes that end up as scams. They also resist the idea of calm, low-cost investing over the decades, likely because they find it boring. Sethi cautioned that marriage with dreamers could be complicated and highly volatile. However, the biggest relationship problem isn’t overspending but the lack of a rich life vision built together by the partners.

Having A ‘Money Guy’ Isn’t Always A Good Sign

Another red flag Sethi highlighted is a partner claiming they have a “money guy” to manage their finances because many don’t want to learn the basics of money. While hiring a financial adviser is smart, choosing the right one is crucial because not all are legally required to recommend the best investments for you. Sethi estimated that if you pay 1% of your $1 million portfolio annually in asset under management (AUM) fees, you could lose almost 28% of your lifetime investment returns.

He claimed it is a red flag if the partner isn’t worried about how much they are paying someone to manage their money, which is generally a percentage of your portfolio and grows over time. Beware of dates who are cheap, cautioned Sethi, because “cost is the first and the last thing they consider,” which can be emotionally draining. He explains that cheap people always fixate on the cost and are oblivious to their impact on those around them, which can be difficult to change.

Sethi’s Perspective On Prenups

A prenuptial agreement is a legal contract between two people before marriage that lets them decide how the assets and responsibilities they bring into the marriage will be settled in case of death or divorce. Sethi believes that prenups can work when couples have substantial assets before marriage. The best way to discuss prenup is to be straightforward about why you want it, but be thorough, given the technicalities and rules involved around assets, children, and duration of marriage, which can lead to future disagreements if overlooked.