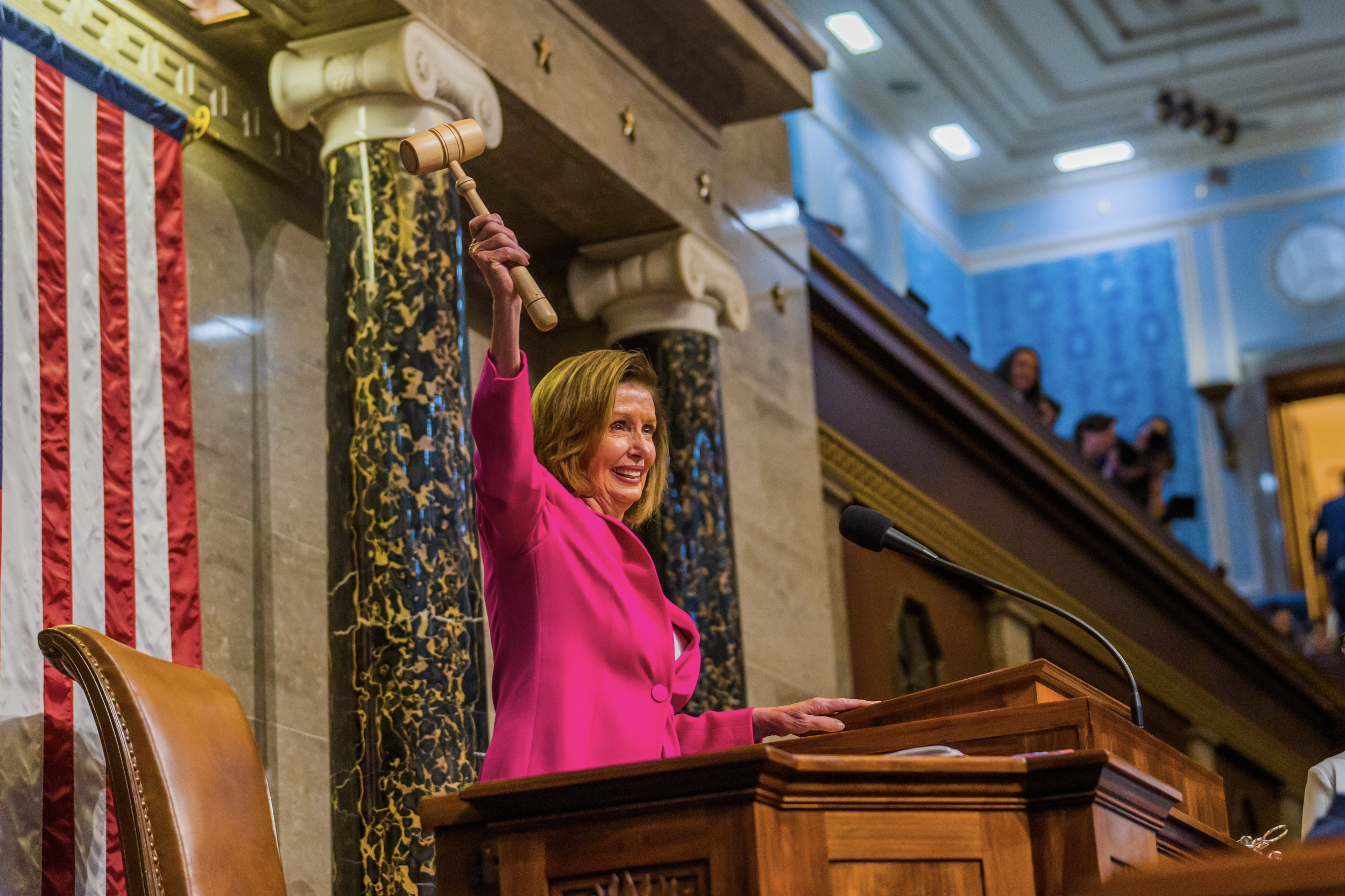

California Representative Nancy Pelosi’s investment portfolio has returned over 700% since 2014. While the former House Speaker’s husband, Paul, executes the trades, his impressive track record of consistently timing the market has given rise to criticism that Nancy could be sharing confidential market information with him, something the politician has refuted for years. While she has hinted at supporting the ETHICS Act floored by bipartisan senators this year to ban Congressional trades, Paul, an investment banker, continues to carry out trades that continue to baffle investors worldwide.

Pelosi Sold 5,000 Microsoft Shares In July After Multiple Security Incidents Involving Microsoft

According to a periodic transaction report dated July 30, Pelosi sold 5,000 Microsoft shares worth over $2.1 million at the time. Unusual Whales, which tracks major stock market transactions, including Congressional trades, tweeted on X.com that it was her “largest sell in two years of her portfolio.” While the selloff happened less than two weeks after the Crowdstrike crash that impacted millions of devices operating on Microsoft Windows systems, Paul also likely averted significant investment losses as America’s top watchdog, the Federal Trade Commission, led by Lina Khan, opened a wide-ranging antitrust investigation on November 27 into Microsoft’s cloud computing, software licensing, cybersecurity, and AI segments, seeking extensive details into its business practices. The FTC conducted informal interviews with business partners and Microsoft rivals before formally notifying the AI giant to hand over information crucial to the agency’s probe. Both the FTC and Microsoft have declined to comment on the matter.

FTC Scrutiny Deepens As Microsoft Remains A Top Government Contractor

Microsoft is among the biggest government contractors, offering billions of dollars worth of software products and cloud computing services to US agencies, including the US Department of Defense. The FTC pointed out in a report late last year that extreme cloud market concentration implies that “outages, or other issues that degrade the service of a cloud provider, could have a cascading impact on the economy or specific sectors.” The FTC believes that recent cybersecurity breaches involving Microsoft, despite being a top government contractor, highlight the company’s excessive influence over the booming market. Meanwhile, sources have reportedly stated that the latest probe revolves around Microsoft bundling its office productivity tools and security offerings with its cloud services. Furthermore, the investigation also focuses on Microsoft’s business practices involving Microsoft Entra ID, formerly Azuer Active Directory, which authenticates users logging into cloud-based software. Rivals have stressed that Microsoft bundling its software with cloud services makes it difficult for competitor cybersecurity firms to establish a foothold in the rapidly evolving market.

Should You Follow Congressional Trades?

Tracking Pelosi’s trades revealed that she authorised buying Microsoft call options before it secured a US defence contract in 2021. She also bought Nvidia shares in 2022, when Congress passed the CHIPS Act. More recently, in early July of this year, another periodic transaction report showed she sold 2,000 Visa shares valued at over $500,000, less than 12 weeks before the US Department of Justice lodged a civil antitrust lawsuit alleging it fraudulently monopolised the debit card market.

Investors following congressional trades should note that copying their investment choices might not always work. Congress members have 45 days to disclose their trades, which creates a lag between when the public knows about them and when they are actually executed. Some platforms tracking these trades formulate investment strategies based on when the trades are disclosed, which can help investors realise profits over time.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.