This year, stablecoins have extended their influence beyond the crypto market. In recent years, the sector experienced significant growth, with the value of the global stablecoin market exceeding $100 billion.

This growth is primarily driven by the growing interest in crypto from traditional institutions: capital inflows into Bitcoin ETFs have set a benchmark, marking the pouring of funds from traditional finance into the crypto industry and bringing up crypto’s legitimacy.

Another reason for stablecoins’ rise is their application in decentralized finance (DeFi), liquidity management, and trading. Assets like Tether’s USDT and Circle’s USDC have become gateways for many novice crypto traders; the spreading adoption has resulted in nearly 100 million stablecoin holders. The average monthly supply of USDT alone has increased by over $20 billion since January, with monthly stablecoin transactions exceeding $1.3 trillion.

Stablecoins democratize access to financial services and commerce, offering a reliable means of exchange and store of value, especially in regions with unstable local currencies. Their adoption is growing rapidly in Europe, the US, the UAE, and Singapore, leading to greater financial inclusion and economic participation.

As stablecoins become part of financial systems, we’ll explore the latest trends and challenges the sector is facing and assess their potential to benefit global finance.

The Latest Stablecoin Trends and Technology

Regulators have been doubling down on stablecoins, tripling their efforts after Terra’s UST meltdown. Meanwhile, the number of issuers seeking regulatory compliance has been on the rise, too.

Circle, the second-largest stablecoin issuer, has secured an Electronic Money Institution (EMI) license in France to comply with the Markets in Crypto-Assets (MiCA) regulation. Under this license, Circle can issue USDC and EURC stablecoins within a strong regulatory framework and benefit from increased trust and transparency.

Then, the Monetary Authority of Singapore granted a license to Paxos, the issuer of PayPal USD (PYUSD) and Pax Dollar (USDP). Partnering with major players like DBS Bank, Paxos has set a precedent for regulatory cooperation.

In its turn, Ripple is preparing to launch a stablecoin backed by US dollar deposits and treasuries, marking its entry into the $150 billion market.

Technological Developments & Integration

Significant technological developments are also happening in the stablecoin space. AI-powered stablecoins have emerged as a notable trend since last year. Stripe, one of the largest payment processing solutions in the US, has integrated AI-driven features into its platform and is now preparing to support stablecoin transactions. At the same time, Tether has also launched a native AI unit.

Exchanges have also significantly benefited from emphasizing stablecoin integration. For instance, Coinbase’s Q3 2023 report highlighted that its revenue from stablecoins jumped 18%, largely driven by its partnership with Circle. Bitget exchange is introducing new USDC trading pairs (STX/USDC, VELO1/USDC, DYDX/USDC, ETC/USDC, COMP/USDC, 1INCH/USDC) to offer greater choices and liquidity to its users. USDT tokens now hold the largest share in the exchange’s token allocation portfolio, representing 30.4% of Bitget’s reserves.

Above that, Bitget recently introduced USDe as a collateral asset for trading perpetual futures to address the growing demand: Ethena’s synthetic dollar stablecoin USDe gained over 215,000 users within just five months of its launch.

The integration and use of stablecoins within DeFi platforms saw similar growth. The total value locked (TVL) in DeFi protocols utilizing stablecoins has reached approximately $50 billion, driven by increased demand for yield farming, liquidity provision, and cross-border transactions.

Security and Transparency Remain Critical Challenges

Despite the growing adoption and technological developments, the regulatory landscape for stablecoins remains complex and nuanced from one jurisdiction to another. For instance, with MiCA, EU users will heavily rely on USDC, while Tether’s USDT largely dominates the stablecoin market across other regions.

Another two challenges for the issuers are misuse and fraud, especially in the context of money laundering. Regulatory bodies now demand strict measures to track and report suspicious activities, adding another layer of complexity for issuers. Tether has recently ramped up its AML operations by actively freezing accounts related to the latest scams and hacks.

Maintaining a stable value pegged to fiat currencies also poses significant challenges. Stablecoins must hold sufficient reserves to honour redemptions, which requires a high degree of financial oversight.

Future Prospects

The stablecoin market is projected to exceed $2.8 trillion by 2028, highlighting the significant demand for stable, trusted digital currencies. This growth reflects stablecoins’ broader acceptance and integration into everyday financial transactions. Additionally, as stablecoins continue to support emerging technologies such as AI, DeFi, DEX, GameFi, and SocialFi, they will further expand their utility and adoption.

As more individuals and businesses recognize the benefits of stablecoins, their adoption rate is expected to increase further. I expect stablecoins to continue to be an indispensable value exchange medium for exchanges in the future.

Regulation is crucial to ensuring consumer protection and financial stability and reducing the risks associated with stablecoins. Anti-money laundering (AML) compliance will likely become crucial as stablecoins gain traction. Proper supervision can address money laundering, fraud, and market manipulation. The stablecoin regulatory framework has been gradually getting clearer. For one, the MiCA introduced by the European Union legally defines stablecoins and the relevant regulatory scope, allowing exchanges to list stablecoins in compliance and open relevant trading pairs.

With the regulatory frameworks evolving, stablecoins, as an asset class, will play an even more significant role in shaping the future of global finance. While challenges like compliance, security, and systemic risk persist, the potential of stablecoins to democratize financial services makes them an integral part of the future global digital economy.

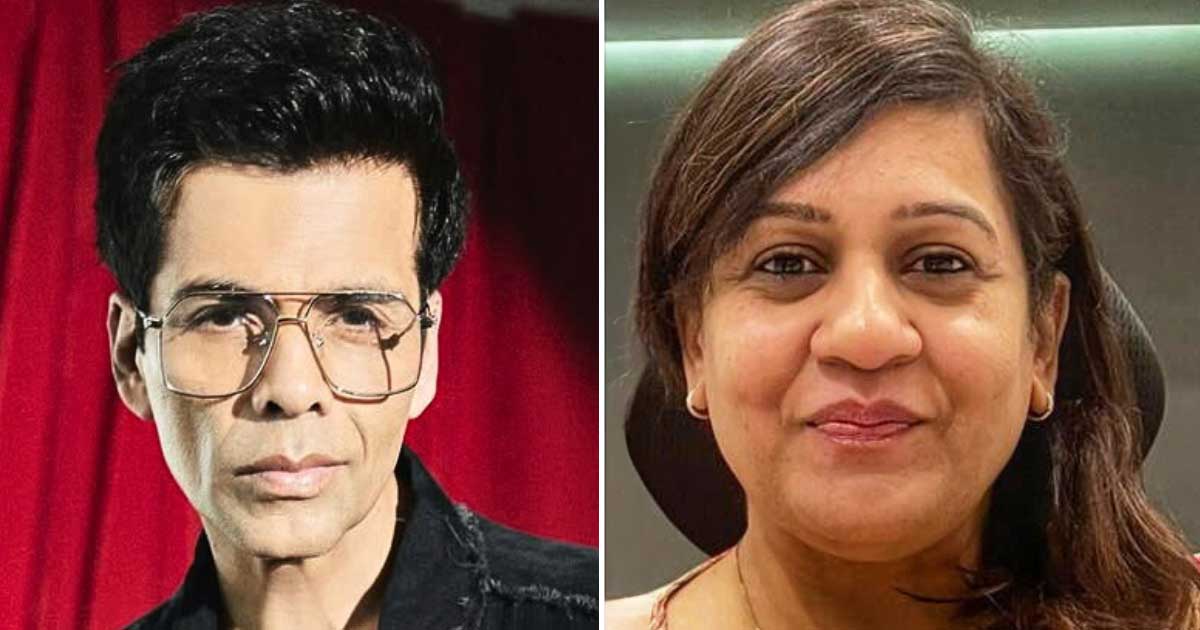

Gracy Chen, CEO of Bitget ( formerly the Managing Director), oversees the growth and expansion of global markets, strategy, execution, business and corporate development of Bitget. She started her journey to the crypto world in 2014, being an investor in the early days of BitKeep (now Bitget Wallet), Asia’s leading decentralized wallet. Gracy was named a Global Shaper by the World Economic Forum in 2015.

Moreover, Gracy has been selected as delegate to attend the recent UN Women CSW68 conference , an event where the UN member states representative and social organizations get together to raise and discuss critical issues impacting gender equality and women’s rights in New York, and address poverty and diversity problems and strengthening institutions and financing with a gender perspective.