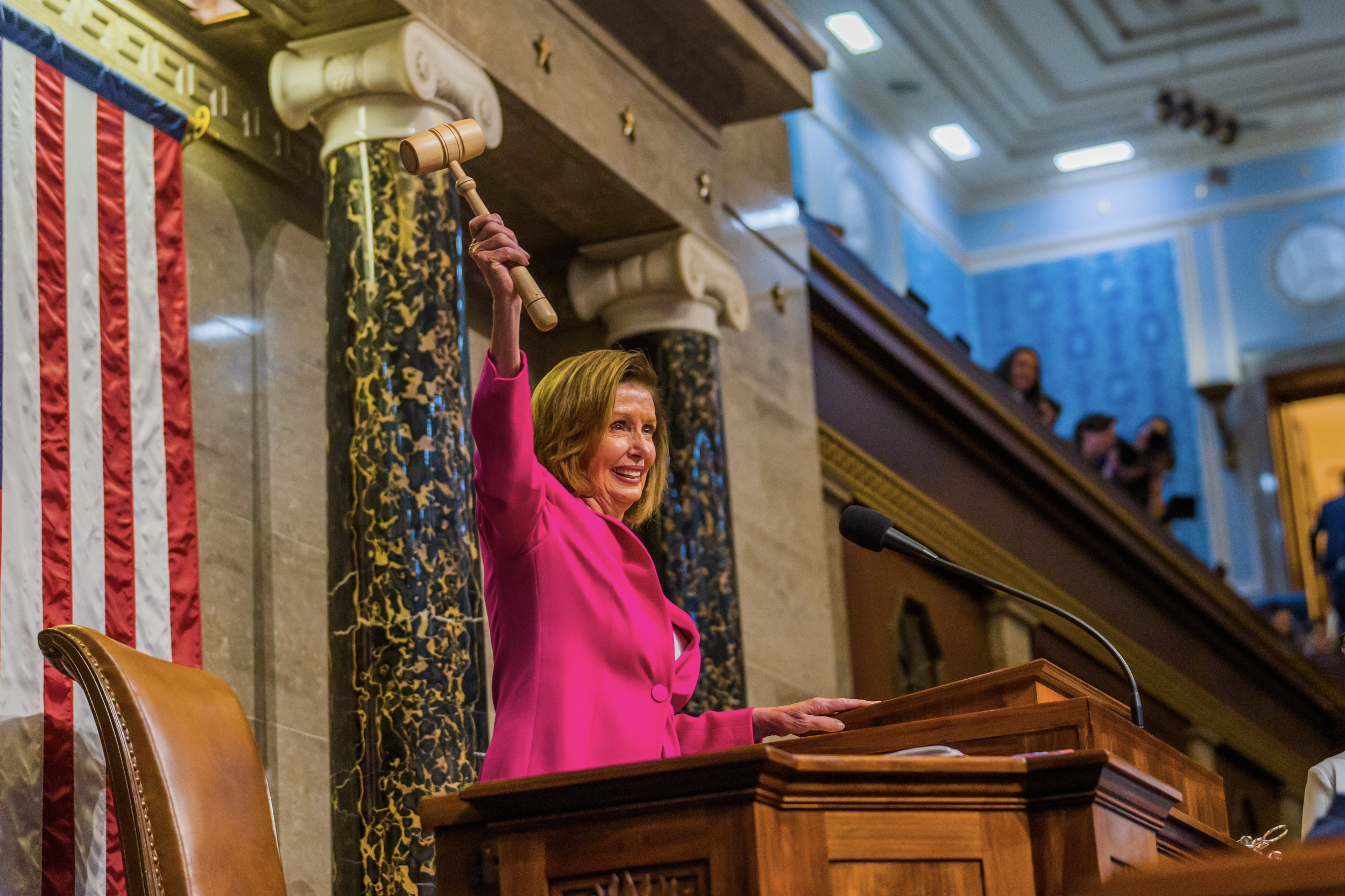

According to former House Speaker Nancy Pelosi’s July 30 periodic transaction report, her husband, Paul Pelosi, bought 10,000 shares of Nvidia valued between $1 million and $5 million and sold 5,000 shares of Microsoft. The move comes after Pelosi recently bought 10,000 shares of Nvidia on June 26, according to a July 2 financial disclosure. The early July report also showed the purchase of 20 Broadcom call options with a strike price of $800 and a June 2025 expiry, executed before Broadcom’s recent 10-for-1 stock split, which reduced the stock’s price to $170.

She and Paul have been criticised for supposedly making trades based on insider information. The former speaker has continued to reject the idea of new legislation, stating in 2021 that “we are a free-market economy.” A couple of years ago, she also refuted the idea that Paul made trades based on the information she offered him. However, in 2022, she was willing to support legislation limiting Congressional trades. Last month, several bipartisan senators introduced a new bill, the ETHICS Act, which, if passed, will ban Congress from trading stocks and slap huge fines for violations. Senator Jeff Hawley said, “There is no reason why members of Congress ought to be profiting off of the information that only they get.”

Nancy Pelosi is popular among investors tracking Congressional trades, given her impressive returns of an estimated 700% since May 2014. The high returns have prompted several institutions to track the portfolios of Congress members and even issue ETFs aligned with their trades. Despite the gains, trades like Broadcom and buying 50 Nvidia call options in November 2023 with a $120 strike price and a December 2024 expiry, way before Nvidia’s stock split this year, have been mounting more pressure on Congress to introduce laws that ban its members from trading in stocks.

Nvidia Likely To Post Surprise Positive Q2 Earnings

Representatives Morgan McGarvey of Kentucky and Stephen Lynch of Massachusetts are among Congress members who also buy Nvidia shares. The company will announce its Q2 earnings result soon. After meeting Nvidia CFO Collette Kress, Goldman Sachs recently wrote that the company will silence its critics with surprise upbeat earnings. Kress said Nvidia will also begin disclosing ROI metrics, such as how its AI GPUs generate profits for end-users and investors. The decision is likely to boost investor confidence.

Goldman Sachs also forecast limited revenue from the Blackwell GPU chips for Nvidia’s third quarter, “followed by a more significant ramp in FY4Q (January) and FY1Q (April).” It retained a “Buy” rating on the stock with a target price of $135 per share.

Microsoft’s Service Outages Continue, Misses AI-business Estimates

On July 30, Microsoft reported widespread outages across several services, including Azure and Outlook, possibly due to a network infrastructure problem. The incident follows a global IT outage that rendered over 8 million Windows devices inaccessible, causing industries to lose billions of dollars.

The latest service disruption happened the same day Microsoft announced its results for the quarter ended June 30. Despite posting a marked increase in revenue and operating profits, the company’s AI businesses missed estimates. The Azure business jumped by 29%, falling short of 31% growth estimates. Meanwhile, its AI-based intelligent cloud unit revenue was $28.5 billion, below projections of $28.7 billion. The stock price has declined by over 8% in the past month to close at $418.35 on July 31.

Should You Copy Congressional Trades?

The primary challenge investors can face when copying trades made by Congress members is the reporting lag between the trade execution date and when it is disclosed to the public. Congress members must report trades within 45 days of placing them but have a provision for a 90-day extension. However, emerging alternate data platforms are devising investing strategies based on when Congressional trades are disclosed to the public to address the reporting lag.

Simultaneously, many Congress members trade highly overvalued stocks susceptible to market sentiment. Investors can partner with a fiduciary financial adviser to eliminate risky investment instruments like options and volatile stocks from their portfolio tracking Congressional trades. These advisers are legally obliged to act in your best interests.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.