The Swiss luxury group Richemont, which owns

Cartier and other jewellery brands, is regularly the subject of takeover

rumours which its founder, the South African billionaire Johann Rupert, always

dismisses.

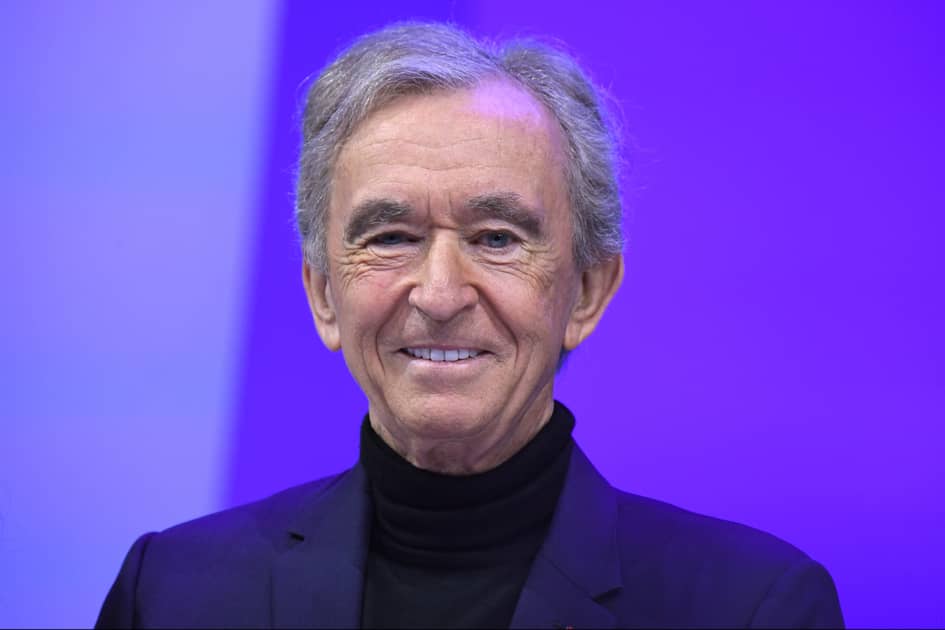

But Bernard Arnault, chief executive of rival LVMH, the number one in the

field, is building up a stake in Richemont — a move which so far has

triggered more questions than answers.

In May, Richemont announced that Rupert, 74, would hand off some of his

responsibilities to a new CEO, Nicolas Bos.

What makes Richemont a prize asset? The answer is in the figures.

Jewel in the crown

Based in Geneva, Richemont’s turnover was 20.6 billion euros (22.5

billion dollars) during its 2023/2024 financial year to the end of March.

It is the world number two or three in the sector, along with the

Gucci-owning French luxury group Kering, depending on annual sales figures.

Jewellery makes up 69 percent of Richemont’s turnover thanks to Cartier,

its flagship brand nicknamed the “jeweller of kings and the king of jewellers”

for its links with royalty.

The group does not disclose its sales by brand, but according to

Jean-Philippe Bertschy, an analyst at Swiss investment managers Vontobel,

Cartier’s turnover was around 11 billion euros during the past financial year.

Richemont also owns the Van Cleef & Arpels luxury brand, which has

experienced “exceptional” growth in recent years, Bertschy said.

By anchoring in jewellery, considered the group’s strong suit, Richemont

has greater resilience in the event of an economic slowdown, with fine

jewellery aimed at a clientele that is far less sensitive to the ups and downs

of the economy.

Watches, fashion and pens

Richemont owns eight watch brands, which make up 18.2 percent of its

turnover. Its portfolio includes Baume & Mercier, IWC Schaffhausen and Piaget.

US investment bank Morgan Stanley and the Swiss firm LuxeConsult estimate

that sales of its largest watch brand, Vacheron Constantin, reached 1.09

billion Swiss francs in 2023, becoming one of eight Swiss brands with a

turnover exceeding one billion francs.

In 1997, its Montblanc pen brand diversified into watches, but it remains

part of the division that brings together around 10 brands in accessories and

fashion (including Chloe and Alaia), including Gianvito Rossi shoes, in which

Richemont took a majority stake last year.

This division is the group’s weakest, according to analysts, including

“several brands which have underperformed for years”, Bertschy said.

However, this division represents just 12.6 percent of Richemont’s annual

turnover.

10 percent of shares, 51 percent voting rights

Rupert, 74, created Richemont in 1988 to bring together the international

assets of the South African Rembrandt group, including the tobacco activities

with which his father Anton made his fortune.

Through acquisitions, the group gradually withdrew from tobacco to refocus

on luxury, including Jaeger-LeCoultre, IWC and A. Lange & Sohne watches.

Rupert holds 10 percent of the capital but 51 percent of the voting rights

through a dual structure of class A and B shares.

The structure offers protection against unsolicited bids, but in 2022 also

helped it thwart an activist fund’s attempt to impose changes to the board.

This protection only amplifies questions about the intentions of Arnault,

one of the world’s wealthiest people.

At the end of June, Bloomberg News reported that the LVMH boss had taken a

stake in Richemont, the amount of which has not been revealed.(AFP)