India’s import duties on electronic-related tariff lines range from zero to 27.5%, burdening manufacturing costs.

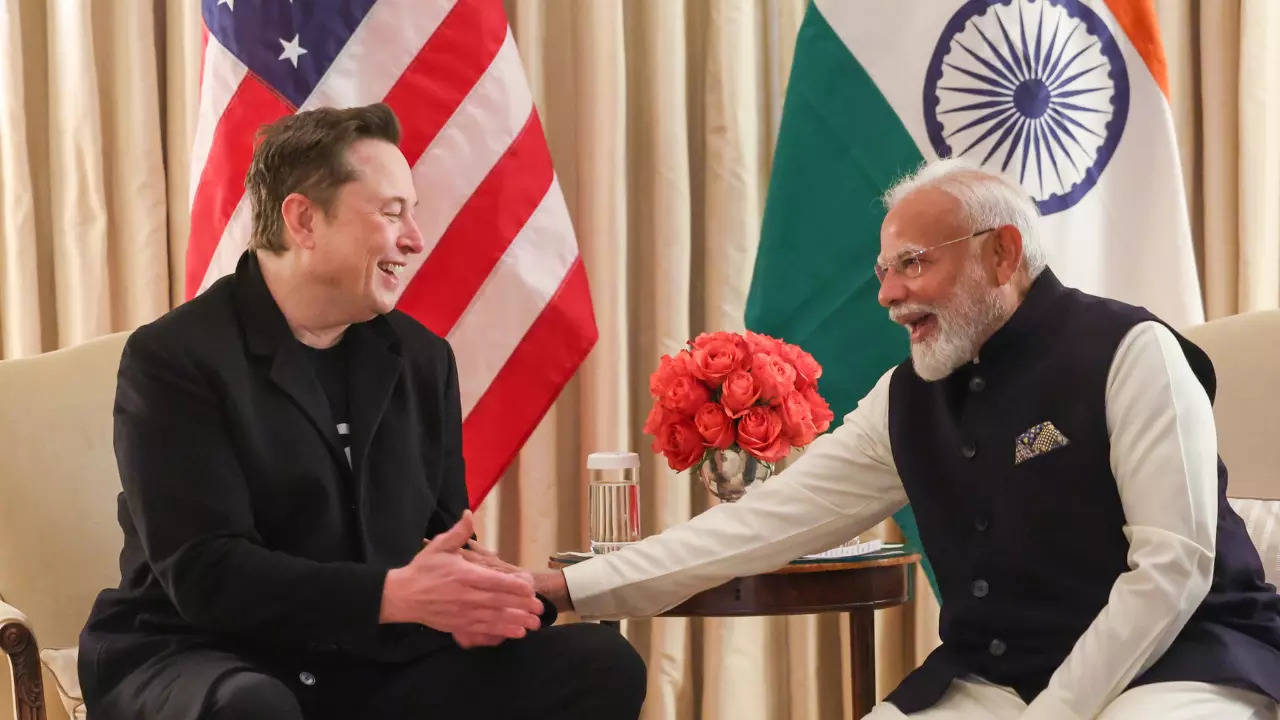

| Photo Credit: Getty Images

Indian industry has urged the government to revisit its restrictions on investment inflows and the movement of skilled personnel from China, and slash high import duties on electronics components as they have made Indian electronics goods globally uncompetitive vis-à-vis rivals such as Vietnam and China rather than boosting localisation of critical inputs.

Warning that the Production Linked Incentive (PLI) scheme for large-scale electronics manufacturing, introduced in April 2020 to offset some cost disadvantages, may soon lose its effectiveness in the face of “tariff-induced cost”, industry players have flagged that the 4%-6% fiscal support under PLI is “grossly inadequate to negate the overall disability as compared to China and Vietnam”.

In a report on “Developing India as the Manufacturing Hub for Electronics Components and Sub-Assemblies”, the Confederation of Indian Industry (CII) has outlined “critical actions required to transition India’s electronics sector ecosystem from an ‘import dependent assembly-led manufacturing’ to ‘component level value-added manufacturing’.

On the restrictions imposed in 2020, through Press Note 3, on foreign direct investment (FDI) from countries sharing land borders with India, the report said the move aimed at preventing predatory acquisitions during the pandemic has now outlived its utility and must be reconsidered with “adequate guardrails”.

Non-restrictive approach

“India should adopt a non-restrictive approach towards investments, component imports, openness towards technology transfer in deficient areas, ease of inward movement of skilled manpower and easing of non-trade tariffs,” the report said, stressing these curbs have hurt India’s component ecosystem development and sent out a message of “non-friendly investment environment”.

In an interdependent world, no country can aspire to produce all components for domestic consumption and a right balance between imports and exports of higher value-added products is the recipe for long term industrial sustenance, the report argued. “The largest electronics manufacturer China with its $1.6 trillion international electronics trade relies on 42% imports,” it pointed out.

“India’s components demand is largely met through imports from China and short-term strategies are likely to have adverse impact on potential expansion of domestic manufacturing… The import tariffs on priority sub-assemblies and components need to be urgently rationalised in line with key competing economies. Majority of tariff lines need to be brought under the level of 5% or lower to ensure that product manufacturers become competitive,” the report mooted.

India’s import duties on 118 electronic-related tariff lines range from zero to 27.5%, with the largest number of components falling in the 10%-15% range, burdening manufacturing costs. About 47.2% of the electronic imports pass through under zero tariff, the remaining 52.8% imports are subjected to varying tariff levels but largely over 10%.

Referring to five ‘priority components and sub-assemblies’ of batteries, camera modules, mechanicals, displays and printed circuit boards, the report said they either have a nominal production in India or are heavily import dependent. In 2023, India’s demand for components and sub-assemblies stood at $45.5 billion to support $102 billion worth of electronics production. This demand is expected to touch $240 billion for $500 billion worth of electronics output by 2030.

“The zero tariff lines for India is less than half of China and Vietnam while these countries make it favourable for importers through less tariff lines under mid and high rates,” the CII report noted. It also recommended a scheme to provide fiscal support in the range of 6%-8% for critical components production.