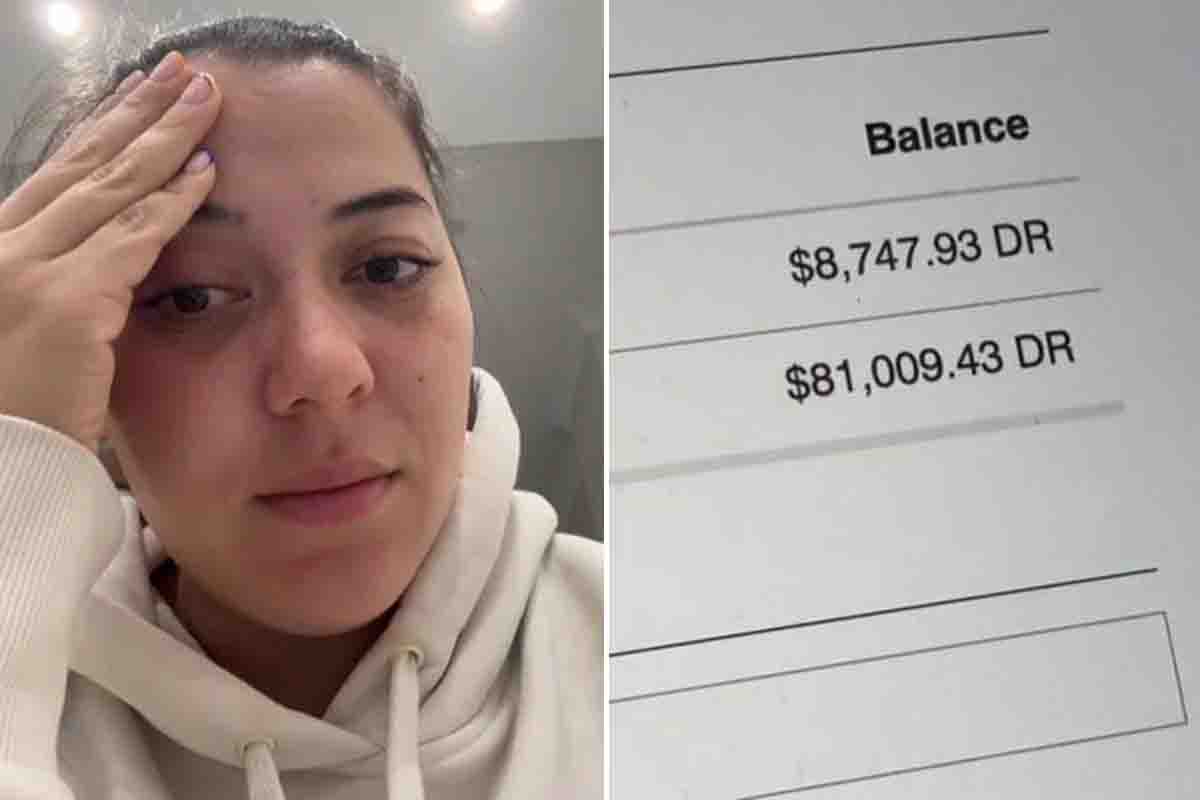

A young woman has expressed frustration over her ballooning HECS debt, fearing she’ll be stuck with it forever due to indexation.

Sydney high school teacher and content creator Alicia Romijn, 28, feels burdened by her student loan debt after completing a double major in Science and a Bachelor’s in urban and Environmental Town Planning, followed by a Master’s in Teaching.

The Silent Increase Eroding Student Loan Progress

Graduating with a $70,000 student loan burden, Romijn now faces a debt of $81,000 due to indexation, which increases loan amounts based on inflation and wages. Despite consistent repayments, her debt continues to grow.

While Romijn enjoys a fulfilling career thanks to her university education, she laments not knowing about the potential increase in her HECS debt. “I started university when I was 17 years old; I didn’t know all the information then that I do now,” she told news.com.au.

“I didn’t know what indexation was,” Romijn admitted, before admitting she is still confused about how it works. When we started university, we were told, ‘this is the cost of the course or the cost per semester, and that’s it.’

Many students, including Alicia, were unaware of indexation and its impact on HECS debt. The significant jump from a 0.6 percent increase to a staggering 7.4 percent came as a surprise. Alicia’s own debt ballooned by $11,000, a fact she only discovered during her 2023-2024 tax return.

Alicia blasted the HECS system, calling it a flawed structure that burdens young people who are pressured to pursue university degrees. The rising debt, she argued, makes repayments seem futile.

Voicing her concern, she asked, “What happens when I decide to have a family and go on maternity leave? Then, the repayments stop again and continue to rise. At this rate, with indexation, who knows how much our HECS debts could really be costing us and if we will ever be able to pay them off?”

Alicia fears the debt will hinder her dream of homeownership. The bi-weekly $500 deductions already strain her finances significantly. In a frank discussion about her student loan burden, Alicia has resonated with her online audience. Many viewers have chimed in, revealing their own struggles with HECS repayments.

“Mine is well into 100K, and I can’t breathe thinking about it,” one wrote. “Life is feeling like a scam at this point,” another added. “Mine indexed and got to 95k. I’ve just accepted I’ll be paying off the index for the rest of my life,” another wrote.

Why Australian Graduates Struggle To Repay Loans

A study by comparison website Finder found that HECS debt varies significantly. The average person owes up to $40,000, with roughly 21 percent owing between $40,000 and $100,000, and a small percentage (just over 1 percent) exceeding $100,000.

Over 63 percent of borrowers with student debt now report feeling slightly or extremely worried about repaying their loans, even though they’re interest-free. This concern has risen significantly from 54 percent just last year.

Alarmingly, the research found that 12 percent, translating to over 354,000 people, believe they will never be able to repay their student debt.

Financial expert Richard Whiten highlighted how soaring inflation last year led to a rise in student loan interest rates, exceeding previous levels. Whiten recommends exceeding minimum repayments whenever possible despite the system’s flexibility.

“If your budget allows, consider small, extra contributions. They can significantly reduce your long-term burden and accelerate repayment,” he said.

“If you have other debts, like a personal loan, a credit card balance or even unpaid buy now pay later charges, you’re likely better off paying those off first. Because the interest or fees will be higher.”

It’s well known that mounting debts can cause anxiety and, in certain cases, like that of developer Brandon Miller—who reportedly committed suicide due to financial strain—can drive individuals to take drastic measures.

A new report highlights the impact of lifestyle creep, where people’s spending habits increase alongside their income. Due to this phenomenon, even high earners like Preston, a Dallas-based accountant making $190,000 annually, need help to make ends meet.

Debt can be a heavy burden, but with awareness and planning, it can be managed. Explore resources for budgeting and student loan repayment strategies. If you’re struggling, remember you’re not alone – share your experiences and find support from others facing similar challenges.