Good morning! It’s Friday, November 1, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

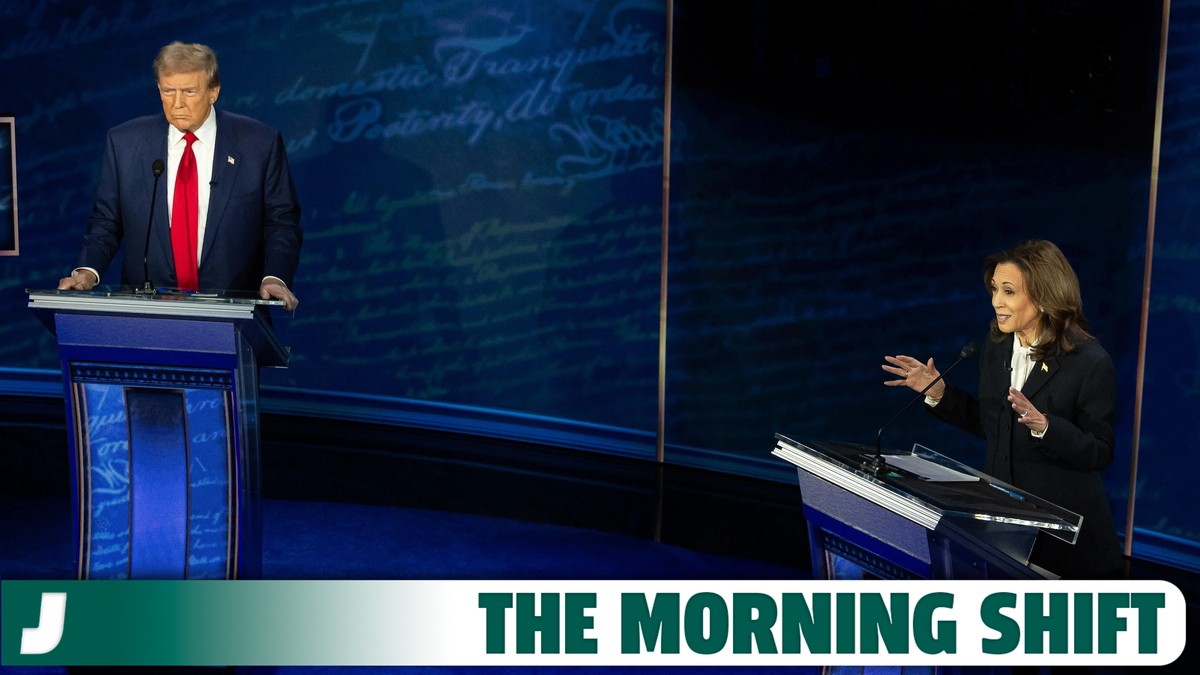

1st Gear: The Future Of EVs Depends On This Election

We’re now just days away from the election, and as nausea-inducing as that is, we’ve still got to talk about what the automotive landscape could look like depending on who wins. President Joe Biden has done a hell of a lot to further the development and widespread use of electric vehicles in the U.S. Whoever comes after him, whether it’s former President Donald Trump or Vice President Kamala Harris, will decide if the car world continues in that direction.

Well, really, it’ll come down to staying the course or dismantling the entire thing for “clean coal” or “liquid gold” or whatever. Here’s how it could shake out. From Bloomberg:

A win for Vice President Kamala Harris and her Democratic Party is unlikely to yield much new legislation, but it will give many of the provisions within the Inflation Reduction Act time to take root. There would also be a likely continuation of EV supply chain funding through the Department of Energy’s Loan Programs Office.

If former President Donald Trump wins the presidency, by contrast, multiple EV-related provisions could be key targets for repeal — especially if Republicans take both houses of Congress.

The clean car tax credit that offers consumers up to $7,500 has long drawn Republican ire. A credit for used EVs could be revoked. And Trump’s administration could opt to close the commercial EV leasing loophole — which offers consumers up to $7,500 toward leases — soon after he enters office, since the executive branch could act on it without having to go through Congress.

Fuel-economy and emissions targets are also certain to undergo rewrites, as they did in the previous Trump term, likely easing conditions on automakers but potentially leading to more market chaos as environmental groups and states like California respond with lawsuits.

The advanced manufacturing tax credit is on firmer ground. This credit was designed to nearshore the EV and battery supply chain and has drawn huge investment.

Still, Trump could make both the purchase and the manufacturing credits harder to access — and he could do so without sign-off from Congress. Most of the $7.5 billion in funds for the US EV charging network should be out the door by the time a new president takes office, but implementation will still matter.

Folks, we also cannot discount the strong possibility of a split outcome where both Democrats and Republicans maintain some sort of control in the White House or Congress. Bloomberg says that would likely leave the status quo pretty much intact.

Democrats controlling the White House and losing Congress would mean more of the IRA and fuel-economy standard policies remain, but even a Democratic House could protect some of these policies under a Republican president.

EVs may not have become a central issue in this election, but the outcome of the race will mean the difference between a quickly growing EV market and a more lethargic one.

Don’t forget to vote on November 5. I’ll personally be pissed at you if you don’t.

2nd Gear: Stellantis Revenue Drops Around The World

Stellantis is in such deep shit, man. Compared to the same time a year ago, the company saw its worldwide revenue drop 27 percent in the third quarter. It’s not exactly a surprise as Stellantis has been dealing with a myriad of issues, including massive inventory numbers in the United States.

Two weeks ago, the automaker released estimates of its shipments, and it showed they were down everywhere but South America. Still, the revenue drop hit every region as well as Maserati. All in all, Stellantis reported global revenues of $36 billion for the third quarter and consolidated shipments of 1.1 million vehicles. That’s down 20 percent. From the Detroit Free Press:

Stellantis, unlike its Detroit Three competitors, releases full earnings reports only for the first and second half of each year, so the results released Thursday don’t show how profitable the automaker was. For the quarter, Ford reported adjusted operating earnings of $2.6 billion, up 18%, and General Motors reported adjusted earnings before interest and taxes of $4.1 billion, up 15.5%, according to prior Free Press reporting.

Among Stellantis’ regions, North America had the steepest revenue decline, down 42% to more than $13 billion (12 billion euros), compared with the same period in 2023. The official tally on shipments was a 36% decline to 299,000 units.

As for net revenues in the other regions, enlarged Europe was down 12%, Middle East and Africa had a 37% drop, South America declined 2%, China, India and Asia-Pacific fell 40% and Maserati, which is typically reported with the company’s regions, fell 61%.

The company, which owns the Jeep, Ram, Chrysler, Dodge and Fiat brands, said it also reaffirmed its previously reduced financial guidance for the year, with an adjusted operating income margin of 5.5 to 7% and industrial free cash flows down more than $5 to $10 billion (5 to 10 billion euros).

[…]

In its news release, the company noted that its stock buyback program of more than $3.36 billion (3 billion euros) was completed in October, returning a total of $8.4 billion (7.7 billion euros) to shareholders in 2024. However, Ostermann noted that a discussion around stock buybacks would be warranted.

Stellantis is planning 20 new product launches in the near future. Hopefully, stuff like the Dodge Charger Daytona, Jeep Wagoneer S electric crossover, Ram 1500 REV and Ram 1500 Ramcharger can jump start sales for the struggling automaker.

Still, it has to contend with massive U.S. dealer inventories.

[T]he automaker expects to have U.S. dealer inventory at less than 350,000 vehicles this month, down from 431,000 vehicles in June, and on track to hit the previously forecast 330,000 units in November. One analyst suggested that the pace of reduction might need to be more aggressive, however.

Figure it out, buddy.

3rd Gear: Judge To Rule On Musk’s Massive Pay Package By Year-End

A judge in Delaware says she will soon issue a ruling on whether or not a vote by Tesla shareholders to reinstate CEO Elon Musk’s $56 billion pay package was valid. It was previously voided by the court. Kathleen McCormick, the chancellor on Delaware’s Court of Chancery, said she will have a ruling by the end of 2024. From Automotive News:

Musk’s 2018 pay package of stock options is by far the largest ever in corporate America. McCormick ruled in January that the “unfathomable” compensation was unfair to Tesla shareholders and found it was negotiated by directors who appeared beholden to Musk.

McCormick is weighing two decisions that will have a multibillion-dollar impact on Tesla and its investors.

One is the request for Tesla to pay a legal fee of $1 billion in cash or more in stock to the lawyers who represented the shareholder who sued Musk over his pay.

The other is to decide whether a June vote by Tesla shareholders restored the pay package after McCormick voided it in her January court ruling.

I really hope Elon gets that money. I mean, the $270 billion he already has is barely enough to get by. How is he going to keep amplifying racists and supporting Donald Trump on a pittance like that?

4th Gear: Ford Lowers Managers’ Bonus Pay Over Poor Company Performance

Ford CEO Jim Farley told employees that the company must hurry its efforts to improve quality and lower costs. Tied to those metrics are manager bonuses, which Farley says are going to be cut to 65 percent of their total. Some middle managers are gonna be really pissed. From Automotive News:

Farley recently introduced a new performance system where company bonuses are directly tied to progress on key goals in an effort to change the 121-year-old automaker’s culture to hold employees more accountable. He made the announcement about the lowered bonuses at a town hall on Wednesday.

“I’m proud of the progress but we’re not satisfied at all,” Farley said in a third-quarter earnings presentation on Monday.

Ford executives said Oct. 28 that the company would meet only the lower end of its annual guidance. Its shares fell more than 10 percent on Oct. 29.

“When we meet or exceed our targets for those factors – and we achieve the ambitious goals of Ford+ – the team is rewarded,” a Ford spokesman said on Thursday. “We are focused on lowering our costs, improving our quality and making Ford a higher growth, higher margin, more capital efficient and more resilient business.”

Not all hope is lost, though. Farley did say bonuses may change depending on the automaker’s fourth-quarter performance. Fingers crossed. We don’t need a “Christmas Vacation” Jelly of the Month Club situation.