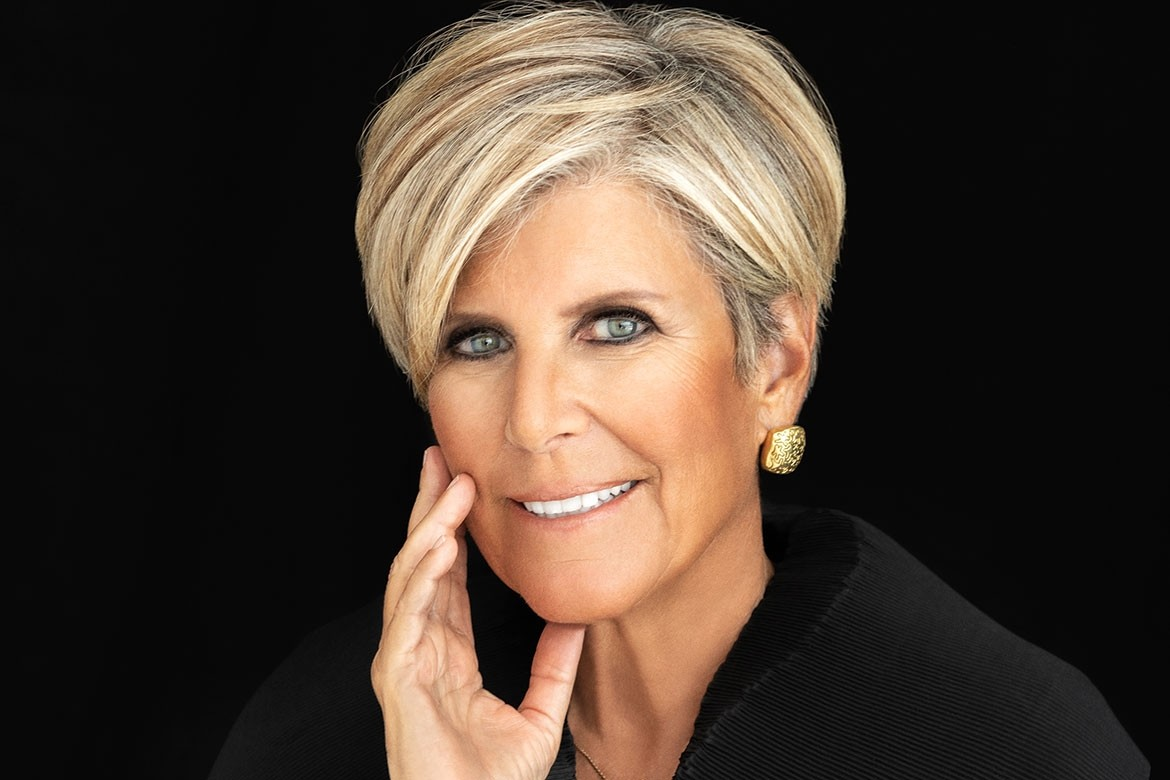

Personal finance expert and former CNBC host Suze Orman told Benzinga last month that Americans planning for retirement should put as much money as possible into a Roth IRA account.

Roth IRAs are individual retirement accounts that allow you to contribute post-tax money from your paycheck that grows tax-free. For 2024, the annual contribution limit in a Roth IRA is $7,000 for those under 50 and $8,000 for those older.

Meanwhile, the annual contribution limit for a Roth 401(k) for 2024 is $23,000 for those below 50. Those 50 and above can add an extra $7,500, taking the yearly limit to $30,500.

Unlike traditional IRAs and 401(k) accounts that grow your pre-tax money and you pay taxes on your withdrawals, Orman said one can withdraw the corpus in a Roth IRA tax-free and penalty-free after the age of 59½.

“If you are not saving for retirement in a Roth, I think there’s a good chance you are making a mistake,” she said. “In my opinion, you should absolutely be putting every single cent into the Roth version of your retirement account.”

While Roth accounts can be beneficial if your estimated marginal taxes are higher in retirement, Orman stressed the major pros around inheritance and estate planning.

“If you’re planning to leave retirement savings as an inheritance, a Roth 401(k) is better here, too,” she noted.

Since there’s no tax on withdrawals from Roth retirement accounts, heirs can inherit them without any tax burden, which can be a major relief, especially if they fall in a higher tax bracket.

What If You Already Have a Traditional 401(k) Account?

Orman suggests that employee-sponsored 401(k) account holders should make contributions up to the limit their employers offer to match. Beyond that, “fully fund your Roth IRA,” she said.

Several employers offer 100% matching for contributions up to 6% of the annual pay on top of employee contributions. Considering a 6% matching contribution, the employee match amount in a year will be a maximum of $6,000 for an annual income of $100,000, which is free money.

“If you have a retirement account at work that matches your contribution, invest up to the point of the match,” she advised while urging those with employer-sponsored plans to take advantage of the employer-contribution matching feature.

However, according to Orman, those without access to employer-sponsored accounts can do with a Roth IRA since account holders can withdraw their contributions anytime, completely tax-free and penalty-free, regardless of their age or the duration of contributions.

While breaking into your egg nest is not advisable, account holders who require access to their Roth IRA funds before retirement for unavoidable situations like a medical emergency can find this feature helpful.

Orman believes that consulting with a financial advisor to chalk out the best savings roadmap based on your specific situation, tax bracket, risk appetite, and retirement goals is vital before capitalising on the advantages of Roth retirement accounts.

While her views on Roth accounts reflect her strategic approach to boosting retirement funds, she also seeks to help individuals make educated financial decisions that offer flexible options for their heirs.