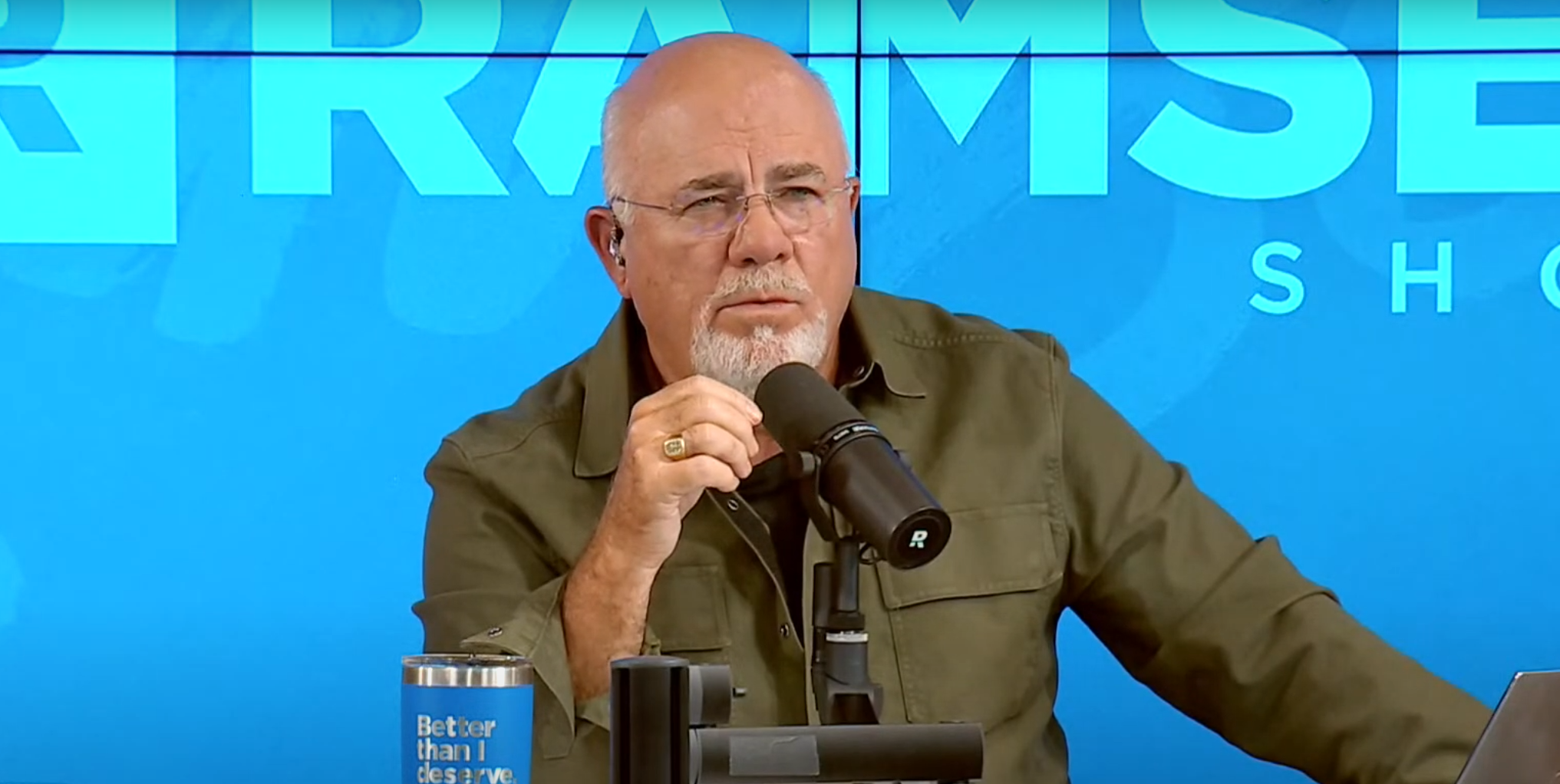

Financial Guru Dave Ramsey isn’t a fan of Social Security. He often describes the program as a “mathematical disaster” that “robbed” him of his own earned money for decades. US Social Security benefits help over 70 million people with monthly income, with the average check estimated to be $1,976 for all retired workers in January 2025. Those retiring at 62 in 2024 could collect a maximum of $2,710 in monthly Social Security income. The checks get as big as $4,874 for US workers retiring at 70 this year.

Americans are increasingly locked into low monthly Social Security income as they retire prematurely due to health reasons, layoffs, or financial distress. You receive full benefits due based on the Social Security payroll taxes you contributed in your working years when you claim at the full retirement age. Most financial experts recommend delaying retirement, often beyond the full retirement age of 67, for those born after 1960, as the benefit amount continues to increase for every month of delay until the age of 70.

Ramsey Is Okay With Claiming Social Security At 62

Despite the conventional wisdom of collecting Social Security as late as possible, Ramsey believes it is fine to collect benefits at 62, but only if you plan to invest all of it. “It usually makes sense to take it early if you’re going to…invest every bit of it,” he said in a 2019 podcast. In response to a query on the podcast about the age at which claiming Social Security makes the most sense, Ramsey said collecting and investing at 62 will result in greater returns compared to waiting until late in life to collect the benefits.

His approach can be bold if we consider a recent joint study from the Federal Reserve Bank of Atlanta, Boston University, and Opendoor Technologies, which found that claiming Social Security at 70 could boost wealth by over $182,000. Meanwhile, claiming at 62 slashes your monthly benefits by 30% for life compared to waiting until your full retirement age.

Investing Social Security Income In Mutual Funds

Ramsey said in the podcast that collecting reduced Social Security benefits at 62 and investing them in a “good mutual fund” could return more than enough to cover the income you lost due to claiming benefits early. “That one account will make you more than enough to cover up the difference between your [age] 66 account and your [age] 62 account,” he said, adding that Social Security is a “broken system.” However, the expert didn’t elaborate on how to identify or define a good mutual fund.

A 2020 Credit Donkey blog report stated that average mutual funds returns over the past two decades stood at 4.67%, much lower than the benchmark S&P 500 index performance, which returned 10.7% annually on average in the past 30 years. Ramsey’s strategy also overlooks the fact that many Social Security recipients claim benefits to pay rent and bills. Hence, they can’t afford to invest the benefits in volatile markets for future returns.

Health Assessment Crucial If Claiming Social Security Early

Claiming Social Security before full retirement age can sometimes make sense. 75-year-old Tim F. followed the general advice of waiting until 70 to collect Social Security to the letter but regrets waiting for so long because he couldn’t fulfil plans he had with his wife, who died at 68. While Tim spent a lot of time planning for the future, he feels claiming the benefits earlier when his wife, Sarah, was alive would been more fulfilling. Although he receives bigger checks, Tim urges retirees to be more realistic about how much time is left.

He explained that one might not experience much health decline while transitioning from 30s to 40s, but a year in old age could mean several health changes. Hence, considering factors beyond your Social Security check size, like your health status and dreams you want to fulfil with your partner, is also vital when deciding when to claim Social Security benefits.