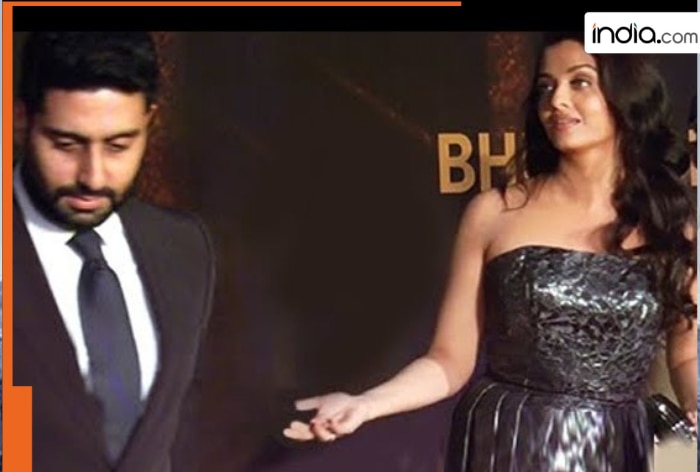

People walk along at financial district of Lujiazui in Shanghai, China October 15, 2021. REUTERS.

China’s underperforming economy has been keeping investors at bay and in the latest, Moody’s has cut its outlook for Chinese sovereign bonds to negative from stable.

The rating agency has cited lower medium-term economic growth and risks from a major correction in the property sector of the world’s second-largest economy.

Moody’s has, however, retained a long-term rating of A1 on the nation’s sovereign bonds. China’s usage of fiscal stimulus to support local governments and state-owned companies is posing downside risks to the nation’s economy, the agency said in a statement.

Related Articles

Double Whammy: China’s already beleaguered banks may be pushed to play lifebuoy for realty in rags

China’s Xi Jinping says economic recovery ‘still at critical stage’, lists measures for revival

Moody’s said the downgrade reflects growing evidence that authorities will have to provide financial support for debt-struck local governments and state firms, posing broad risks to China’s fiscal, economic and institutional strength.

“The outlook change also reflects the increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector,” Moody’s said.

China has been ramping up its borrowing to bolster its economy which is raising concerns about the nation’s debt levels with Beijing on track for record bond issuance this year.

Moody’s last cut its credit rating on China in 2017, to A1 from Aa3, citing expectations of slowing growth and rising debt.

While Moody’s affirmed China’s A1 long-term local and foreign-currency issuer ratings on Tuesday, it said it expects the country’s annual GDP growth to slow to 4.0 per cent in 2024 and 2025, and to average 3.8 per cent from 2026 to 2030.

As per reports, most analysts believe that China’s economy is on track to hit the government’s annual growth target of around 5 per cent this year, but activity is highly uneven.

China has struggled to mount a strong post-COVID recovery as a deepening crisis in the housing market, local government debt risks, slow global growth and geopolitical tensions have dented momentum. A flurry of policy support measures has proven only modestly beneficial, raising pressure on authorities to roll out more stimulus.

According to the latest data from the International Monetary Fund (IMF), debt of local government in China has reached 92 trillion yuan ($12.6 trillion), or 76 per cent of the country’s economic output in 2022, up from 62.2 per cent in 2019.

After years of over-investment in infrastructure, plummeting returns from land sales, and soaring costs to battle COVID-19, economists say debt-laden municipalities now represent a major risk to the economy.

China unhappy with Moody’s downgrade

China’s Finance Ministry said it was disappointed by Moody’s downgrade. The country further said the economy will maintain its rebound and positive trend. It also said property and local government risks are controllable.

“Moody’s concerns about China’s economic growth prospects, fiscal sustainability and other aspects are unnecessary,” the ministry said.

In October, China unveiled a plan to issue 1 trillion yuan ($139.84 billion) in sovereign bonds by the end of the year to help kick-start activity, raising the 2023 budget deficit target to 3.8 per cent of GDP from the original 3 per cent.

The central bank has also implemented modest interest rate cuts and pumped more cash into the economy in recent months, pledging to sustain policy support.

With inputs from agencies