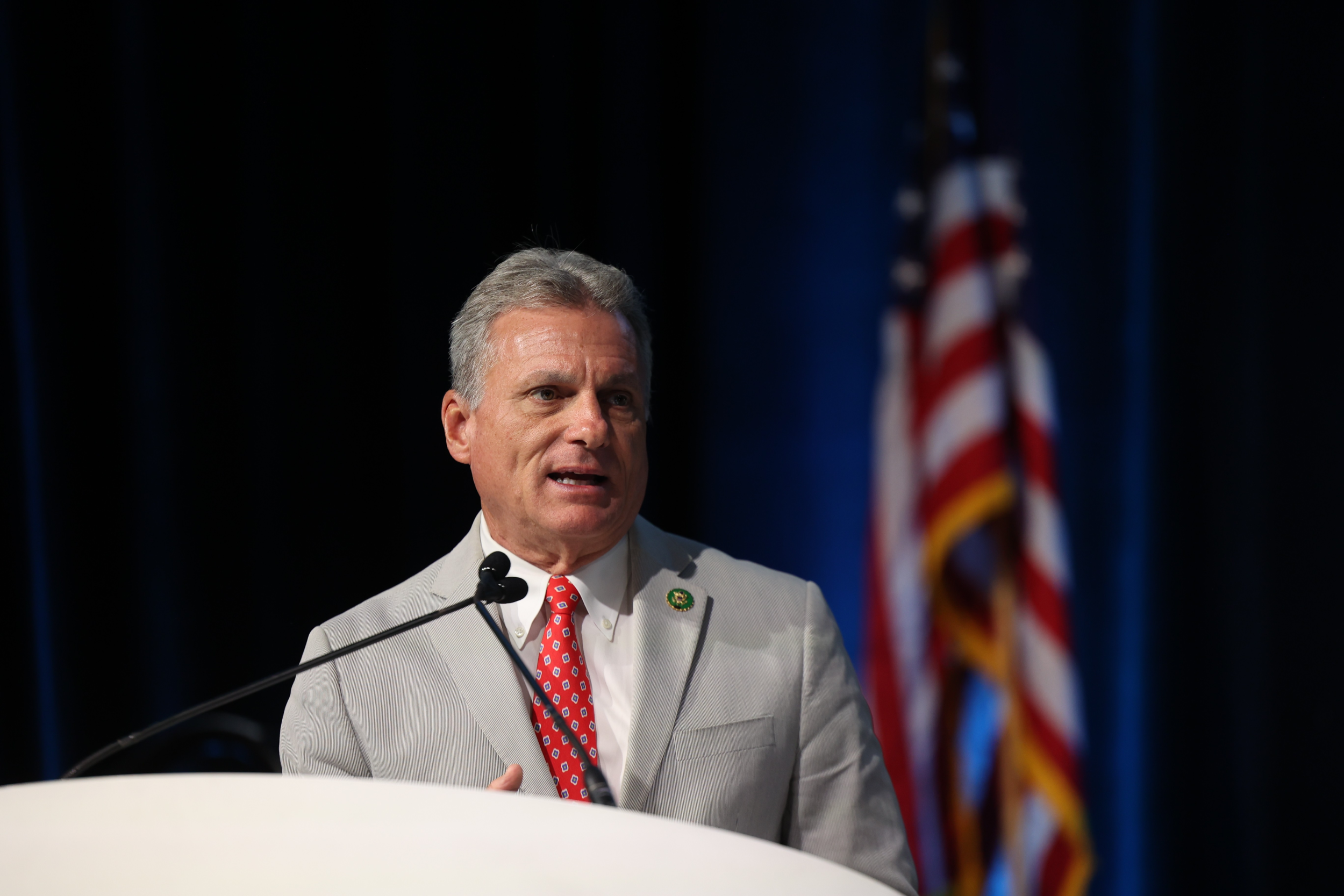

Earl LeRoy “Buddy” Carter, the US representative for Georgia’s 1st Congressional district, announced the introduction of H.R. 25, the Fair Tax Act, via a 9th January press release to replace the current US tax code.

The Republican Congressman proposed abolishing income, death, gift, and payroll taxes and replacing them with a single national consumption tax. The Fair Tax Act would also eliminate the requirement for the Internal Revenue Service.

Legislation That Aims To Simplify The US Tax Code

Carter said the Fair Tax law would do precisely that: tax people fairly. He is confident that it is the only simple tax proposal out there that would promote growth and enable Americans to keep “every cent of their hard-earned money.”

Carter, also a pharmacist, said the Fair Tax Act would put Americans in charge of their tax rates rather than bureaucrats while highlighting the need for eliminating the IRS altogether.

Meanwhile, Representative Barry Loudermilk, serving Georgia’s 11th Congressional district, highlighted that Americans shouldn’t require lawyers or accountants to file taxes but a simple tax code that promotes growth and opportunity for more Americans to flourish financially.

“Taxpayers should not have IRS agents targeting them for wanting to keep more of their hard-earned money,” he stated in the press release. Loudermilk is an original co-sponsor of the bill.

Some representatives also believe the proposed law is a commonsense solution to foster economic prosperity and empower hardworking taxpayers.

In a myth versus fact budget blog, Buddy stated the new Act would allow a family of four to spend £24,742 ($30,000) yearly without paying a penny in taxes. It will also save small businesses hundreds of billions of dollars annually in compliance costs.

He highlighted that even retired individuals on a fixed income will be exempt from Social Security benefit taxes as well as taxes on investment and pension incomes alongside withdrawals from Individual Retirement Accounts.

A Path To Reducing National Debt and Tax Loopholes

US Representative Dale Whitney Strong, who represents Alabama’s 5th Congressional district and is also a co-sponsor of the Fair Tax bill, stated that the non-discriminatory and unintrusive tax law would ensure that everyone in the country, including illegal immigrants, pays their fair share of taxes.

Meanwhile, Americans for Fair Taxation President Steve Hayes explained that the new bill would mandate illegal immigrants to pay taxes while denying them the consumption allowance available to all legal US residents.

Referring to President-elect Donald Trump’s call for border security and tax reforms, Hayes said the Fair Tax Act would eliminate any scope of people using taxpayer-funded resources without paying into the system, making all those residing illegally in the country accountable. He believes the Act is a “must-pass legislation for 2025.”

Furthermore, Georgia Representative Richard Dean McCormick explained that the Fair Tax system would buoy the revenue base and minimise tax loopholes. He added that promoting household savings and stable income would also offer the nation a sustainable gateway to lowering the soaring national debt and help it return to the desired fiscal growth track.

The US national debt stood at a record £29.82 trillion ($36.16 trillion).